When it comes to shopping for car insurance after purchasing a new vehicle, there are crucial factors to consider that can significantly impact your coverage and costs. Exploring the ins and outs of insurance options post-purchase is essential to ensure you have the right protection in place.

Let's delve into the intricacies of this process and help you navigate the world of car insurance seamlessly.

Researching Car Insurance Options

When it comes to researching car insurance options after purchasing a new vehicle, there are several important factors to consider. Your coverage needs may change with the acquisition of a new car, and it is crucial to compare quotes from different insurance providers to ensure you are getting the best deal possible.

Factors to Consider

- Vehicle Type: The type of vehicle you have purchased can impact the cost of insurance. Factors such as the make, model, and age of the car can influence the coverage options available to you.

- Driving Habits: Your driving habits and the amount of time you spend on the road can affect the type of coverage you need. If you have a long commute or frequently drive in high-traffic areas, you may require more comprehensive coverage.

- Budget: It is essential to consider your budget when researching car insurance options. While you want to ensure you have adequate coverage, you also need to find a policy that fits within your financial means.

Changing Coverage Needs

When purchasing a new vehicle, your coverage needs may change due to factors such as the value of the car, loan requirements, and potential risks associated with the specific make and model. It is important to review your existing policy and make adjustments to ensure your new vehicle is adequately protected.

Comparing Quotes

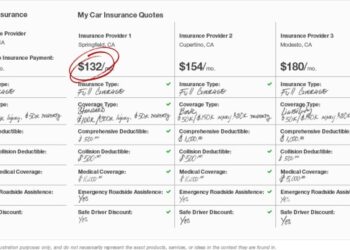

- It is highly recommended to obtain quotes from multiple insurance providers to compare coverage options and pricing.

- By comparing quotes, you can ensure you are getting the best value for your money and identify any potential savings or discounts available.

- Take the time to review the details of each quote carefully to understand the coverage limits, deductibles, and any additional benefits included in the policy.

Understanding Coverage Types

When it comes to car insurance for new vehicles, understanding the different coverage types available is crucial to ensure you have the right protection in place.

Liability Coverage

- Liability coverage is mandatory in most states and helps cover costs if you're at fault in an accident that causes injury or property damage to others.

- It does not cover your own vehicle damage, but it can protect you from costly lawsuits and medical expenses for others involved.

- For example, if you rear-end another vehicle and the driver sustains injuries, liability coverage would help cover their medical bills and vehicle repairs.

Collision Coverage

- Collision coverage helps pay for repairs to your own vehicle if you're involved in an accident, regardless of fault.

- It can also cover the cost of replacing your vehicle if it's deemed a total loss.

- For instance, if you hit a tree and damage your car, collision coverage would kick in to cover the repair costs.

Comprehensive Coverage

- Comprehensive coverage protects your vehicle from non-collision related incidents, such as theft, vandalism, or natural disasters.

- It covers repair or replacement costs for your vehicle in these situations.

- For example, if your car is stolen or damaged in a hailstorm, comprehensive coverage would help cover the losses.

Factors Affecting Insurance Rates

When it comes to determining insurance rates for a new vehicle, several factors come into play. These factors can vary significantly from one individual to another, impacting the overall cost of insurance premiums.

Impact of Make, Model, and Year of the Vehicle

The make, model, and year of a vehicle play a crucial role in determining insurance rates. Generally, newer and more expensive cars tend to have higher insurance premiums due to the cost of repairs or replacement in case of damage or theft.

Additionally, high-performance vehicles or luxury cars may also result in higher premiums due to their increased risk of accidents or theft.

Personal Factors Influence on Insurance Costs

Personal factors, such as driving history and location, can also greatly influence insurance costs. A clean driving record with no accidents or traffic violations typically leads to lower insurance rates, as it demonstrates responsible driving behavior. On the other hand, individuals living in areas with high crime rates or heavy traffic congestion may face higher insurance premiums due to the increased risk of accidents or theft in those areas.

Customizing Insurance Policies

When it comes to customizing insurance policies for your new vehicle, it's important to consider your specific needs and budget. Adding optional coverage can provide you with extra protection and peace of mind in case of unexpected events. Here are some tips on how new vehicle owners can tailor their insurance policies to suit their individual requirements.

Adding Optional Coverage

Adding optional coverage to your insurance policy can give you additional protection beyond the basic coverage. One popular optional coverage is roadside assistance, which can help you in case of breakdowns or emergencies while on the road. Another beneficial option is rental car reimbursement, which covers the cost of a rental vehicle if your car is in the shop for repairs after an accident.

- Consider adding comprehensive coverage to protect your vehicle against non-collision incidents like theft, vandalism, or natural disasters.

- Personal injury protection (PIP) can cover medical expenses for you and your passengers in case of an accident, regardless of who is at fault.

- Uninsured/underinsured motorist coverage can provide financial protection if you're involved in an accident with a driver who doesn't have insurance or enough coverage.

Renewing and Reviewing Policies

After purchasing a new vehicle, it is crucial to review and renew your car insurance policy to ensure that you have the appropriate coverage for your updated vehicle. By keeping your policy up to date, you can avoid any gaps in coverage and potentially save money by adjusting your policy based on your current needs.

Renewing an Existing Policy with Updated Vehicle Information

When renewing your car insurance policy after buying a new vehicle, follow these steps to update your information:

- Contact your insurance provider: Reach out to your insurance company to inform them of your new vehicle purchase.

- Provide details: Share the make, model, year, and vehicle identification number (VIN) of your new car with your insurance agent.

- Review coverage options: Take this opportunity to review your coverage options and make any necessary adjustments to ensure you have adequate protection.

- Update your policy: Once all the information is verified and updated, your insurance provider will renew your policy with the new vehicle details.

Benefits of Reviewing Policies Periodically

Regularly reviewing your car insurance policy can offer several benefits, including:

- Ensuring adequate coverage: By assessing your policy periodically, you can make sure you have the right coverage for your current needs.

- Identifying potential savings: Reviewing your policy may uncover opportunities to save money by adjusting coverage or taking advantage of discounts.

- Staying informed: Keeping up to date with your policy can help you understand any changes in coverage or rates, allowing you to make informed decisions.

- Peace of mind: Knowing that your insurance policy aligns with your current situation can provide peace of mind in case of unexpected events.

Closing Notes

In conclusion, shopping for car insurance after buying a new vehicle is a critical step in safeguarding your investment and ensuring peace of mind on the road. By understanding the nuances of coverage types, factors affecting rates, and the importance of customizing policies, you can make informed decisions that align with your needs.

Remember to review and renew your policy periodically to stay updated and adequately protected.

Top FAQs

What factors should I consider when researching car insurance options for my new vehicle?

Factors to consider include the make and model of your vehicle, your driving history, location, and coverage needs.

How can I customize my insurance policy to suit my needs as a new vehicle owner?

New vehicle owners can customize their policies by adding optional coverage like roadside assistance or rental car reimbursement to tailor protection to their requirements.

Why is it important to review and renew car insurance policies after buying a new vehicle?

Reviewing and renewing policies ensures that your coverage aligns with your current vehicle and needs, helping you stay adequately protected on the road.