As Shop Car Insurance Quotes by State: 2025 Guide takes center stage, this opening passage beckons readers with a comprehensive exploration of the nuances involved in shopping for car insurance quotes by state. It delves into the factors influencing rates, the impact of state-specific regulations, and the anticipated trends in pricing for the year 2025.

Overview of Car Insurance Quotes by State in 2025

Shopping for car insurance quotes by state is crucial for all drivers to ensure they are getting the best coverage at the most affordable rates. The cost of car insurance can vary significantly depending on the state you reside in, so comparing quotes from different insurance providers in your state is essential.

Factors Influencing Car Insurance Rates at a State Level

Several factors can influence car insurance rates at a state level, including:

- The number of accidents and claims filed in a specific state can impact insurance rates. States with higher accident rates may have higher premiums to cover the increased risk.

- State laws and regulations regarding insurance requirements and coverage options can also affect rates. Some states have mandatory coverage types that can impact pricing.

- The population density of a state can influence insurance rates. Urban areas with higher population densities may have more traffic congestion and a greater risk of accidents, leading to higher premiums.

- Weather conditions in a state can also play a role in insurance rates. States prone to severe weather events like hurricanes or snowstorms may have higher premiums to cover potential damage to vehicles.

Variation of Car Insurance Quotes Across Different States

Car insurance quotes can vary significantly across different states due to various factors such as:

- State-specific regulations and coverage requirements can impact the cost of insurance policies. Some states may have more expensive minimum coverage requirements than others.

- The level of competition among insurance providers in a state can affect pricing. States with more insurance companies competing for business may have lower premiums.

- Demographic factors such as age, gender, and credit score can also influence car insurance rates, and these demographics can vary from state to state.

- The frequency of insurance claims and the overall risk profile of drivers in a state can impact insurance rates. States with a higher frequency of claims may have higher premiums for all drivers.

State-specific Factors Affecting Car Insurance Quotes

When it comes to car insurance, the rates can vary significantly from state to state. This is due to a variety of factors that influence how insurance companies determine their pricing. Understanding these state-specific factors can help drivers make informed decisions when shopping for car insurance.

State Regulations Impacting Car Insurance Pricing

State regulations play a crucial role in determining car insurance rates. Each state has its own set of laws and regulations that govern the insurance industry. For example, some states have no-fault insurance laws, which can impact how claims are handled and, in turn, affect insurance rates.

Additionally, states may have different minimum coverage requirements, which can also influence pricing.

Demographic Trends and Car Insurance Rates

Demographic trends, such as population density, average income levels, and age distribution, can also impact car insurance rates. Urban areas with higher population densities tend to have more accidents, leading to higher insurance rates. Similarly, areas with lower average income levels may see higher rates of uninsured drivers, which can drive up insurance costs for everyone in the area.

Key Factors in Each State

- In states prone to natural disasters, such as hurricanes or wildfires, insurance rates may be higher to account for the increased risk of claims.

- States with high rates of vehicle theft may also have higher insurance premiums to cover the risk of theft-related claims.

- States with strict driving laws and enforcement may have lower rates of accidents, leading to lower insurance premiums for drivers in those states.

Trends in Car Insurance Quotes for 2025

As we look ahead to 2025, several trends are expected to influence car insurance pricing and coverage options. Advancements in technology, changes in consumer behavior, and regulatory shifts are likely to impact how insurance companies determine rates and offerings.

Impact of Advancements in Technology

With the rise of connected cars, telematics, and artificial intelligence, insurance companies have access to more data than ever before

As technology continues to evolve, we may see a shift towards usage-based insurance models where premiums are directly linked to how, when, and where a vehicle is driven.

Potential Changes in Coverage Options

Insurance companies may start offering more flexible coverage options tailored to the needs of modern drivers. This could include on-demand insurance policies, pay-as-you-go plans, or bundled packages that combine auto insurance with other types of coverage. Additionally, as autonomous vehicles become more prevalent, insurers may need to rethink traditional coverage structures to account for new risks and liabilities.

Shift in Pricing Strategies

As competition in the insurance industry intensifies, companies may adjust their pricing strategies to attract and retain customers. This could involve offering discounts for safe driving behavior, loyalty programs for long-term policyholders, or incentives for bundling multiple insurance products. Insurers may also explore new ways to assess risk beyond traditional factors like age and driving history, incorporating data from IoT devices and smart technology to refine their pricing models.

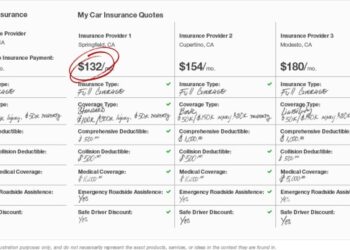

Comparison of Car Insurance Quotes Across States

When comparing car insurance quotes across different states in 2025, it becomes evident that there are significant variations in premiums, deductibles, and coverage options. These differences can be attributed to a variety of factors that influence the cost of car insurance in each state.

State A vs. State B: Premiums

When looking at State A and State B, it is clear that the average premiums for car insurance are much higher in State A compared to State B. This difference can be due to factors such as population density, frequency of accidents, and the level of competition among insurance providers in each state.

State C vs. State D: Deductibles

In State C, the deductibles for car insurance policies tend to be lower compared to State D. This could be influenced by state regulations, the average income of residents, and the prevalence of insurance fraud in each state.

State E vs. State F: Coverage Options

When comparing State E and State F, it is noticeable that the coverage options offered by insurance companies differ significantly. State E may have more comprehensive coverage options available, while State F might focus more on basic coverage at lower costs.

These variations can be linked to state laws and regulations governing insurance coverage.

Ultimate Conclusion

Conclusively, navigating the realm of car insurance quotes by state requires an understanding of the intricate interplay between regulations, demographics, and emerging technologies. The insights gained from this guide pave the way for informed decision-making and a proactive approach towards securing the most suitable coverage.

FAQs

How do state-specific factors influence car insurance quotes?

State-specific factors such as regulations, demographics, and even advancements in technology can significantly impact car insurance quotes.

What are the predicted trends in car insurance pricing for 2025?

Expected trends in 2025 include changes in coverage options, pricing strategies by insurance companies, and potential variations in premiums.

Why do car insurance quotes vary across different states?

Variations in car insurance quotes among states can be attributed to differences in state regulations, demographics, and risk factors specific to each region.