As Shop Auto Insurance Online: Best Platforms Compared takes center stage, this opening passage beckons readers with engaging insights into a world of insurance platforms. Get ready to explore the best options available and make informed decisions.

Delve into the realm of auto insurance platforms and discover the key factors that set them apart in terms of coverage, customization, cost, and customer support.

Researching Auto Insurance Platforms

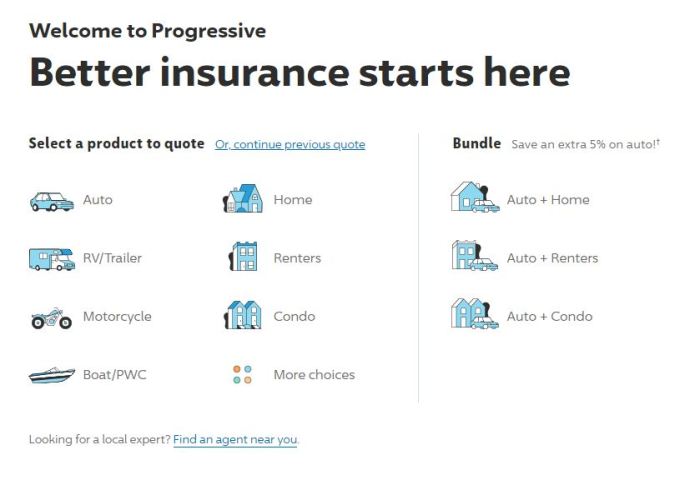

When researching auto insurance platforms, it is essential to compare the user interface, key features, and ease of navigating through the insurance purchasing process on different online platforms.

Comparison of User Interface

- Platform A: Offers a clean and intuitive interface with easy access to important information.

- Platform B: Features a modern design with interactive elements for a user-friendly experience.

- Platform C: Provides a simple layout with clear navigation menus for seamless browsing.

Key Features Offered by Each Platform

- Platform A: Offers personalized quotes based on user input and a variety of coverage options.

- Platform B: Provides a comparison tool to easily compare different insurance plans and prices.

- Platform C: Includes a chat support feature for quick assistance during the insurance purchasing process.

Ease of Navigating Through the Insurance Purchasing Process

- Platform A: Guides users step-by-step through the insurance purchasing process, making it easy to understand and complete.

- Platform B: Streamlines the process by automatically filling in information based on user data, saving time and effort.

- Platform C: Offers a progress tracker to show users where they are in the purchasing process and what steps are left to complete.

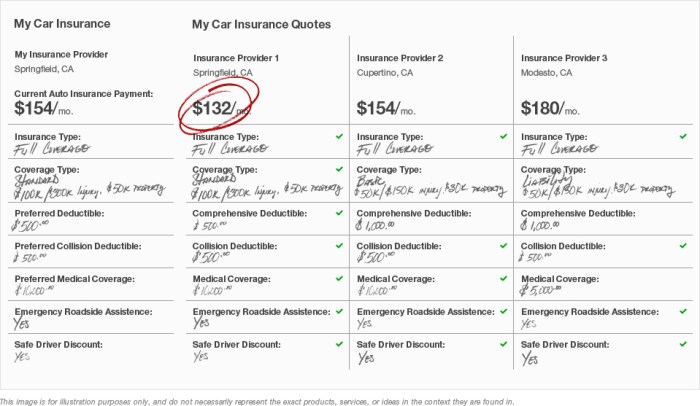

Coverage Options and Customization

When it comes to auto insurance platforms, understanding the coverage options and customization features is crucial for tailoring a policy to meet individual needs. Let's explore the types of coverage available and the level of customization offered on these platforms.

Types of Auto Insurance Coverage

- Liability Coverage: This coverage helps pay for damage and injuries you cause to others in an accident.

- Collision Coverage: Covers damage to your vehicle in the event of a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Helps cover expenses if you're in an accident with a driver who has insufficient or no insurance.

Level of Customization

Insurance platforms offer varying degrees of customization to allow policyholders to tailor their coverage to their specific needs. Some platforms may offer more flexibility in adjusting coverage limits and deductibles than others. It's important to consider how much control you want over your policy when choosing a platform.

Cost and Discounts

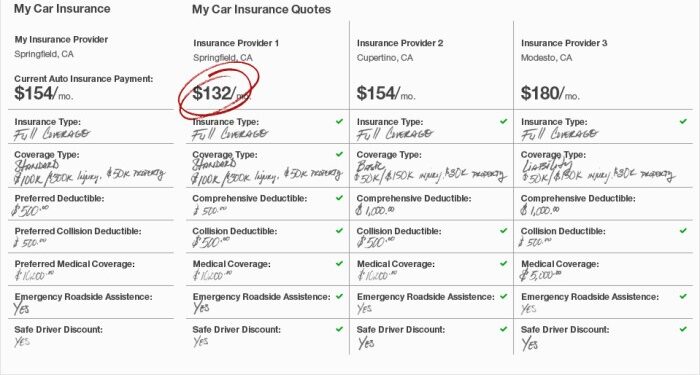

When it comes to auto insurance, understanding the cost and available discounts is crucial in making an informed decision. Let's delve into how pricing structures vary across different online platforms and the discounts they offer to policyholders.

Pricing Structure Analysis

- Each online platform may have a unique pricing structure based on factors such as age, driving history, location, and type of vehicle.

- Some platforms offer usage-based insurance, where premiums are determined by driving habits and mileage.

- Comparing quotes from multiple platforms can help in finding the most competitive rates for your specific profile.

Discounts and Incentives

- Many online insurance platforms provide discounts for factors like safe driving records, bundling policies, and completing defensive driving courses.

- Some platforms offer loyalty discounts for long-term policyholders or discounts for paying premiums in full upfront.

- Discounts may also be available for students with good grades, military personnel, or members of certain organizations.

Bundling Options Impact

- Bundling multiple insurance policies, such as auto and home insurance, with the same provider can lead to significant cost savings.

- Insurance companies often offer discounts for bundling to incentivize customers to consolidate their policies under one provider.

- By bundling, policyholders can enjoy convenience, potential discounts, and streamlined management of their insurance needs.

Customer Support and Claims Process

When it comes to purchasing auto insurance online, the level of customer support and efficiency of the claims process are crucial factors to consider. Let's evaluate the options available and compare the different platforms.

Customer Support Options

- Most auto insurance platforms offer customer support through phone, email, or live chat.

- Some platforms have 24/7 customer support, providing assistance at any time of the day.

- Look for platforms that have dedicated customer service representatives who can address your queries and concerns promptly.

Efficiency of Claims Process

- Platforms differ in the speed and ease of processing claims, so it's important to choose one with a streamlined claims process.

- Check if the platform offers online claims filing to expedite the process and reduce paperwork.

- Read reviews from existing customers to get an idea of how efficient the claims process is on a particular platform.

Additional Services and Resources

- Some platforms offer resources like online portals or mobile apps for customers to manage their claims and inquiries conveniently.

- Look for platforms that provide guidance on how to file a claim correctly to avoid any delays or complications.

- Consider platforms that offer additional services such as rental car reimbursement or roadside assistance to enhance your coverage.

Closing Notes

In conclusion, navigating the world of online auto insurance platforms can be a daunting task, but armed with the information provided, you can make confident choices that suit your needs. Compare, analyze, and choose wisely for a secure driving experience.

FAQ Corner

How do I compare auto insurance platforms?

Compare the user interface, key features, and ease of navigation on different online platforms to make an informed decision.

Can I customize my auto insurance plan?

Yes, explore the customization options available on each platform to tailor insurance plans to your individual needs.

Are there discounts available?

Identify discounts or incentives provided by each platform to potentially save on your auto insurance costs.

How does customer support work for online auto insurance purchases?

Evaluate the customer support options available for assistance with purchasing auto insurance online.

What should I consider when comparing claims processes?

Compare the efficiency of claims processes on different platforms to ensure a smooth experience in case of an incident.