Starting off with Shop Auto Insurance Coverage Options: Complete Guide, this introductory paragraph aims to grab the attention of the readers with a compelling overview of the topic.

The following paragraph will delve into the details and provide comprehensive information on the subject.

Understanding Auto Insurance Coverage

When it comes to auto insurance, understanding the different types of coverage available is crucial in ensuring you have the right protection in place. Let's explore the basic types of auto insurance coverage and examples of situations where each type is beneficial.

Liability Coverage

Liability coverage is essential for covering damages or injuries to others in an accident where you are at fault. This type of coverage helps pay for the other party's medical bills and property damage. For example, if you rear-end another vehicle and it is determined to be your fault, liability coverage will help cover the cost of the other driver's car repairs and medical expenses.

Collision Coverage

Collision coverage is designed to help pay for repairs to your own vehicle in the event of a collision, regardless of fault. This coverage is beneficial if you are involved in a single-vehicle accident, hit a stationary object, or collide with another vehicle.

For instance, if you accidentally back into a pole and damage your car, collision coverage can help cover the cost of repairs.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision related incidents such as theft, vandalism, fire, or natural disasters. This coverage is beneficial in scenarios where your car is damaged or stolen due to events beyond your control. For example, if your car is stolen or damaged in a flood, comprehensive coverage can help cover the cost of replacing or repairing your vehicle.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage provides coverage for medical expenses and lost wages for you and your passengers, regardless of fault. This coverage can be helpful in covering medical bills and lost income resulting from an accident. For instance, if you are injured in a car accident and unable to work, PIP coverage can help cover your medical expenses and lost wages.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage protects you in the event of an accident with a driver who does not have insurance or does not have enough coverage to pay for your damages. This coverage is important in situations where the at-fault driver is uninsured or underinsured.

For example, if you are hit by a driver who does not have insurance, uninsured/underinsured motorist coverage can help cover your medical expenses and vehicle repairs.

Comprehensive Coverage

Comprehensive coverage is an essential component of auto insurance that provides protection for your vehicle in situations that are not related to collisions. This type of coverage helps pay for damages caused by events such as theft, vandalism, natural disasters, or hitting an animal.

What Does Comprehensive Coverage Include?

Comprehensive coverage typically includes damages to your vehicle that are not caused by a collision. This can include:

- Damages from theft

- Damage from natural disasters like floods or earthquakes

- Broken or shattered windows

- Damages from hitting an animal

- Vandalism

Scenarios Where Comprehensive Coverage is Essential

Comprehensive coverage is essential in situations where your vehicle may be at risk of non-collision damage. For example:

- If you live in an area prone to natural disasters

- If your car is parked on the street and at risk of vandalism

- If you frequently drive in rural areas where hitting an animal is a possibility

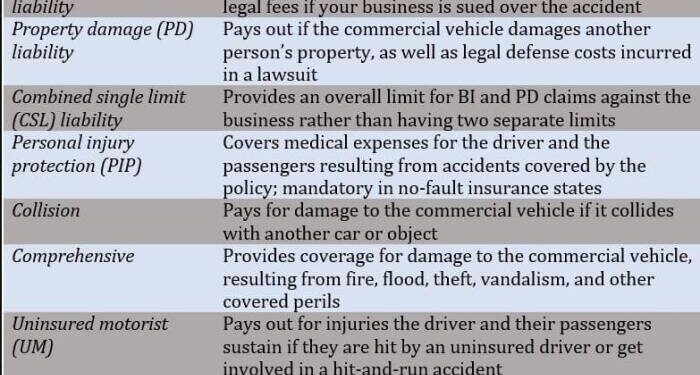

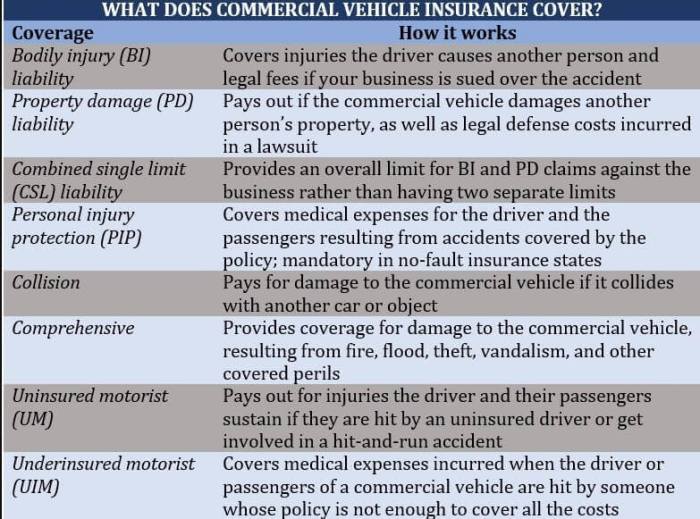

Comparing Comprehensive Coverage with Other Types

Comprehensive coverage differs from collision coverage, which only applies to damages caused by a collision with another vehicle or object. Liability coverage, on the other hand, covers damages and injuries to others in an accident where you are at fault.

Comprehensive coverage is essential for protecting your vehicle from a range of non-collision-related damages, making it a valuable addition to your auto insurance policy.

Collision Coverage

Collision coverage is a type of auto insurance that helps pay for repairs or replacement of your vehicle if it's damaged in a collision with another vehicle or object.

Significance of Collision Coverage

Having collision coverage can provide financial protection in case of accidents that result in damage to your vehicle. This coverage can help you avoid paying out-of-pocket for costly repairs or replacement.

Examples of When Collision Coverage Comes into Play

- If you accidentally hit another car while changing lanes on the highway.

- If you collide with a tree or light pole while parking.

- If your vehicle is damaged in a hit-and-run accident.

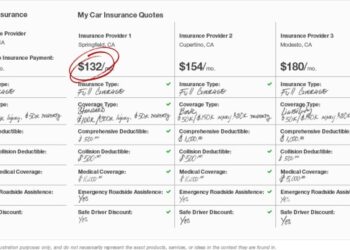

Factors to Consider for Collision Coverage Limits

- Your vehicle's value: Consider the current market value of your car to determine if collision coverage is worth it.

- Your driving habits: If you frequently drive in high-traffic areas or have a history of accidents, higher coverage limits may be beneficial.

- Your budget: Evaluate how much you can afford to pay out-of-pocket for repairs or replacement in case of an accident.

Liability Coverage

When it comes to auto insurance, liability coverage is crucial as it helps protect you financially if you are at fault in an accident that causes injuries or damages to others. This coverage is typically required by law in most states to ensure that you can cover the costs of any harm you may cause.

Components of Liability Coverage

- Bodily Injury Liability: This component helps cover the medical expenses of individuals injured in an accident where you are at fault.

- Property Damage Liability: This part of liability coverage helps pay for repairs or replacement of property that you damage in an accident.

Recommended Coverage Limits

It is important to choose liability coverage limits that provide adequate protection in case of an accident. Recommended coverage limits for liability are typically expressed as three numbers, such as 100/300/50, which represent:

- $100,000per person for bodily injury

- $300,000per accident for bodily injury

- $50,000per accident for property damage

These limits ensure that you have sufficient coverage to handle potential expenses resulting from an accident for which you are held responsible.

Personal Injury Protection (PIP) and Medical Payments Coverage

When it comes to auto insurance coverage options, Personal Injury Protection (PIP) and Medical Payments Coverage are crucial components that can help cover medical expenses in the event of an accident. Let's delve into the details of these two types of coverage and understand their benefits.

Personal Injury Protection (PIP)

Personal Injury Protection, commonly known as PIP, is a type of auto insurance coverage that pays for medical expenses, lost wages, and other related costs resulting from a car accident, regardless of who is at fault. This coverage is mandatory in some states and provides broader protection compared to Medical Payments Coverage.

- PIP covers a wider range of expenses, including rehabilitation costs, funeral expenses, and even childcare expenses.

- It typically has higher coverage limits than Medical Payments Coverage, providing more financial protection in case of severe injuries.

- PIP can also cover household services that the injured person may no longer be able to perform due to the accident.

PIP is often referred to as "no-fault" coverage because it pays out regardless of who caused the accident.

Medical Payments Coverage

Medical Payments Coverage, also known as MedPay, is another type of auto insurance coverage that helps pay for medical expenses resulting from a car accident. Unlike PIP, MedPay is not as comprehensive and typically covers only medical expenses without additional benefits like lost wages or household services.

- MedPay can cover medical expenses for you and your passengers, regardless of fault.

- It can help bridge the gap in coverage if you have high health insurance deductibles or co-pays.

- Medical Payments Coverage is optional in most states, but it can provide valuable financial assistance in covering medical bills after an accident.

State Requirements and Impact on Decision

The decision to choose between PIP and Medical Payments Coverage may be influenced by state requirements. Some states mandate the inclusion of PIP in auto insurance policies, while others leave it as an optional coverage. Understanding your state's regulations and minimum coverage requirements can help you make an informed decision on which type of coverage to choose.

- States with no-fault insurance systems often require PIP coverage to ensure that medical expenses are covered promptly, regardless of fault.

- States without no-fault systems may leave the choice between PIP and MedPay to the policyholder, based on their individual needs and preferences.

- Consider factors such as your health insurance coverage, financial situation, and the level of protection you desire when deciding between PIP and Medical Payments Coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage is a crucial component of auto insurance that provides protection in situations where you are involved in an accident with a driver who does not have insurance or has insufficient coverage to pay for damages.

Importance of Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage is essential because it helps cover medical expenses, lost wages, and property damage if you are hit by a driver who is uninsured or underinsured. Without this coverage, you may be left to pay for these costs out of pocket.

- It ensures that you are financially protected in case of an accident with an uninsured or underinsured driver.

- It can help cover expenses that your health insurance may not, such as lost wages.

- It provides peace of mind knowing that you have added protection in case of a collision with an uninsured motorist.

Situations Where Uninsured/Underinsured Motorist Coverage Proves Invaluable

Uninsured/Underinsured Motorist Coverage can prove invaluable in various situations, such as:

- Being hit by a driver who does not have insurance.

- Being involved in a hit-and-run accident where the at-fault driver cannot be identified.

- Being hit by a driver whose insurance coverage is not enough to cover all your expenses.

Variations in Coverage Options for Uninsured/Underinsured Motorists

When it comes to Uninsured/Underinsured Motorist Coverage, there are different options available, including:

- Underinsured Motorist Coverage: Helps cover expenses if the at-fault driver has insurance, but it is not enough to cover all of your damages.

- Uninsured Motorist Bodily Injury Coverage: Covers medical expenses if you are injured by an uninsured driver.

- Uninsured Motorist Property Damage Coverage: Helps pay for repairs to your vehicle if it is damaged by an uninsured driver.

Summary

Wrapping up our discussion on Shop Auto Insurance Coverage Options: Complete Guide, this concluding paragraph will recap the key points and leave readers with a lasting impression.

Expert Answers

What does comprehensive coverage include?

Comprehensive coverage typically includes protection against damages not caused by a collision, such as theft, vandalism, or natural disasters.

Why is liability coverage important?

Liability coverage is crucial as it helps cover costs if you're at fault in an accident that causes damage to someone else's property or injures another person.

What is the difference between PIP and medical payments coverage?

Personal Injury Protection (PIP) typically covers a broader range of expenses, including medical bills, lost wages, and even funeral costs, while medical payments coverage focuses solely on medical expenses.

Why is uninsured/underinsured motorist coverage necessary?

Uninsured/underinsured motorist coverage is essential to protect you if you're involved in an accident with a driver who doesn't have insurance or enough coverage to pay for damages.