Embark on a journey to understand the intricacies of shopping for car insurance quotes the smart way. This guide will equip you with the knowledge and tools needed to make informed decisions and secure the best coverage for your vehicle.

Exploring the nuances of different insurance coverage types, premium calculations, and factors influencing rates is crucial in navigating the complex world of car insurance.

Understand the Basics of Car Insurance

Car insurance is a crucial aspect of owning and operating a vehicle. It provides financial protection in case of accidents, theft, or damage to your car. To navigate the world of car insurance effectively, it is essential to understand the different types of coverage, how premiums are calculated, and the factors that can influence insurance rates.

Types of Car Insurance Coverage

There are several types of car insurance coverage available to drivers:

- Liability Coverage: This coverage pays for damages to another person's property or medical expenses if you are at fault in an accident.

- Collision Coverage: This coverage helps pay for repairs to your own vehicle after a collision, regardless of who is at fault.

- Comprehensive Coverage: This coverage helps pay for damages to your vehicle that are not related to a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are in an accident with a driver who has insufficient insurance or no insurance at all.

How Car Insurance Premiums are Calculated

Car insurance premiums are calculated based on several factors, including:

- Your driving record

- Your age, gender, and marital status

- The type of car you drive

- Your location

- The coverage limits you choose

Insurers use complex algorithms to assess risk and determine the likelihood of you filing a claim. Safer drivers with clean records typically pay lower premiums.

Factors that can Affect Car Insurance Rates

Several factors can influence your car insurance rates, including:

- Driving record: Accidents and traffic violations can increase your rates.

- Age and experience: Younger and less experienced drivers often pay more for insurance.

- Location: Urban areas with higher rates of accidents or theft may result in higher premiums.

- Credit history: Insurers may use your credit score to determine your rates.

Research and Compare Insurance Quotes

Researching and comparing insurance quotes is a crucial step in finding the best car insurance policy for your needs. It allows you to explore the different options available to you and make an informed decision based on coverage, cost, and customer service.

Tip 1: Research Different Insurance Companies

When researching insurance companies, consider factors such as financial stability, customer reviews, and the range of coverage options offered. Look for companies with a good reputation for customer service and claims handling.

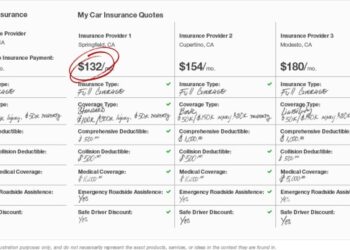

Tip 2: Compare Quotes from Multiple Providers

Obtaining quotes from multiple insurance providers allows you to compare prices and coverage options. Be sure to request quotes for the same level of coverage from each company to make a fair comparison.

Tip 3: Use Online Tools for Efficient Comparison

Online tools and comparison websites make it easy to compare insurance quotes from multiple providers quickly and efficiently. These tools can help you see side-by-side comparisons of prices and coverage options, making it easier to identify the best deal for your needs.

Consider Your Coverage Needs

When it comes to determining your coverage needs for car insurance, there are several factors to consider. Your decision should be based on your specific circumstances, driving habits, and the type of vehicle you own. It's important to weigh these factors carefully to ensure you have adequate coverage in case of an accident or other unforeseen events.

Factors to Consider

- Value of Your Vehicle: Consider the current market value of your car and whether you would be able to afford repairs or a replacement in case of damage.

- Driving Habits: Evaluate how often you drive, the distance you cover, and whether you have a long commute.

- Financial Situation: Assess your financial stability and ability to pay for potential damages out of pocket.

Optional Coverage Options

- Rental Reimbursement: Covers the cost of a rental car if your vehicle is in the shop for repairs after an accident.

- Roadside Assistance: Provides help in case of a breakdown, flat tire, or other roadside emergencies.

- Gap Insurance: Pays the difference between the actual cash value of your car and the amount you owe on a loan or lease if your car is totaled.

Impact of Driving Habits and Vehicle

Your driving habits and the type of vehicle you own can significantly impact your coverage needs. For example, if you have a long commute or frequently drive in heavy traffic, you may want to consider higher liability limits to protect yourself in case of an accident.

Similarly, if you own a luxury or high-performance vehicle, you may need additional coverage to account for the higher repair or replacement costs.

Review and Understand Policy Details

When it comes to car insurance, reviewing and understanding policy details is crucial to ensure you are adequately covered and aware of what your policy entails. Taking the time to go through the fine print can save you from any surprises or misunderstandings in the future.

Key Items to Look for in an Insurance Policy

- Policy Coverage: Make sure you understand what is covered under your policy, including liability, collision, comprehensive, and any additional coverage options.

- Deductibles: Check the deductible amounts for different types of coverage and understand how they work in case of a claim.

- Policy Limits: Know the maximum amount your insurance will pay out for different types of claims.

- Exclusions: Be aware of any situations or items that are not covered by your policy.

- Endorsements: Look for any additional endorsements or modifications to your policy that may affect coverage.

Common Terms and Jargon Found in Insurance Policies

- Premium: The amount you pay for your insurance coverage.

- Underwriting: The process of evaluating risk and determining the cost of insurance.

- Claim: A request for payment under the terms of your policy.

- Policyholder: The person who owns the insurance policy.

- Grace Period: The period after the due date for a premium payment during which the policy remains in force.

Ask Questions and Seek Clarification

When shopping for car insurance quotes, it is crucial to ask the right questions and seek clarification on any aspects of the policy that are unclear. This will help you make an informed decision and ensure that you have the coverage you need.

Important Questions to Ask Insurance Agents

- What is the coverage limit for bodily injury liability?

- Does the policy cover rental car reimbursement?

- Is roadside assistance included in the policy?

- Are there any discounts available for safe driving or bundling policies?

Importance of Seeking Clarification

- Understanding the policy terms and conditions can prevent surprises in the event of a claim.

- Clarifying any doubts can help you choose the right coverage for your specific needs.

- Knowing what is included and excluded in the policy can prevent misunderstandings later on.

Ensuring Full Understanding of Terms and Conditions

It is essential to carefully read through the policy documents and ask for clarification on any terms or conditions that are unclear.

- Take notes during the conversation with the insurance agent to refer back to later.

- Ask for examples or scenarios to better understand how the coverage works.

- Don't hesitate to ask follow-up questions until you are confident in your understanding of the policy.

Take Advantage of Discounts and Savings

When it comes to car insurance, there are various discounts and savings opportunities that can help you reduce your overall costs. By taking advantage of these discounts, you can potentially save a significant amount of money on your premiums.

Common Discounts Offered by Insurance Companies

- Multi-policy discount: Insurance companies often offer a discount if you bundle your car insurance with another policy, such as homeowners or renters insurance.

- Good driver discount: If you have a clean driving record with no accidents or traffic violations, you may qualify for a good driver discount.

- Low mileage discount: Some insurance companies offer discounts to policyholders who drive fewer miles annually.

- Safety features discount: Installing safety features in your car, such as anti-theft devices or airbags, can lead to discounts on your insurance premiums.

How Bundling Policies Can Lead to Savings

By bundling your car insurance with another policy, such as homeowners insurance, you can often receive a discount on both policies. This can result in significant savings on your overall insurance costs. Insurance companies offer these discounts to incentivize customers to consolidate their policies with one provider.

Tips to Qualify for Various Discounts to Lower Insurance Costs

- Ask your insurance agent about available discounts and how you can qualify for them.

- Maintain a clean driving record to qualify for good driver discounts.

- Consider taking a defensive driving course to potentially qualify for additional discounts.

- Regularly review your policy to ensure you are receiving all the discounts you qualify for.

Final Review

In conclusion, mastering the art of shopping for car insurance quotes the smart way involves being well-informed, proactive, and strategic. By following the tips and guidelines provided in this guide, you can ensure that you make the best choices to protect yourself and your vehicle on the road.

Commonly Asked Questions

How can I lower my car insurance premiums effectively?

One effective way to lower your car insurance premiums is by maintaining a clean driving record and taking advantage of available discounts offered by insurance companies.

What factors should I consider when determining my coverage needs?

When determining your coverage needs, factors such as your driving habits, the type of vehicle you own, and any optional coverage options should be taken into account.

Is it essential to review policy details before purchasing car insurance?

Yes, it is crucial to review policy details carefully to ensure that you understand the coverage, limitations, and terms of the insurance policy you are considering.

How can I qualify for discounts on my car insurance?

You can qualify for discounts on your car insurance by bundling policies, maintaining a good credit score, and completing defensive driving courses, among other strategies.