Exploring the world of auto insurance shopping in 2025, this guide dives deep into the intricacies of finding the best deals with expert precision. From understanding the basics to utilizing cutting-edge technology, this journey will equip you with the knowledge to navigate the insurance landscape like a seasoned pro.

As we embark on this exploration, we will unravel the complexities of auto insurance shopping in the ever-evolving year of 2025, offering insights and strategies to empower your decision-making process.

Understand Auto Insurance Basics

Auto insurance is a crucial aspect of owning a vehicle, providing financial protection in case of accidents or damages. In 2025, it's important to understand the different types of coverage available, factors influencing rates, and the evolving landscape of insurance models.

Types of Auto Insurance Coverage

Auto insurance coverage in 2025 includes:

- Liability Coverage: Covers costs if you're at fault in an accident.

- Collision Coverage: Pays for repairs to your vehicle after a collision.

- Comprehensive Coverage: Protects against non-collision incidents like theft or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers you if the other driver is uninsured or lacks sufficient coverage.

Factors Influencing Auto Insurance Rates

Several factors can impact your auto insurance rates:

- Driving Record: A history of accidents or traffic violations can lead to higher premiums.

- Age and Gender: Younger drivers and males typically pay more for insurance.

- Location: Urban areas with higher rates of accidents or theft may result in higher premiums.

- Vehicle Type: The make, model, and age of your vehicle can affect rates.

Comparison of Traditional vs. Innovative Insurance Models

In 2025, traditional auto insurance models are being challenged by innovative approaches such as:

- Usage-Based Insurance: Rates are determined by driving behavior monitored through telematics devices.

- Peer-to-Peer Insurance: Policyholders form a community to share risk and reduce costs.

- Blockchain Technology: Enhances security and transparency in insurance transactions.

Research and Compare Insurance Providers

When it comes to shopping for auto insurance, researching and comparing different providers is crucial to finding the best coverage at the most competitive rates. Here are some tips on how to effectively research and compare insurance providers:

Researching Reputable Insurance Companies

- Check the financial stability of the insurance company by looking at their credit ratings from agencies like A.M. Best or Standard & Poor's.

- Read customer reviews and ratings online to get a sense of the company's customer service and claims handling reputation.

- Verify the insurance company's license and complaint record with your state's insurance department.

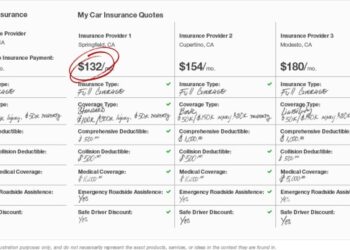

Comparing Quotes from Different Providers

- Obtain quotes from at least three different insurance providers to compare rates and coverage options.

- Ensure that the quotes are for the same coverage limits and deductibles to make an accurate comparison.

- Consider bundling your auto insurance with other policies like home or renters insurance to potentially qualify for discounts.

Key Factors to Consider When Choosing an Insurance Provider

- Look for a company that offers the coverage you need at a price you can afford.

- Consider the insurance company's customer service reputation and claims process efficiency.

- Check for any available discounts or special programs that could lower your insurance premiums.

Utilize Technology for Smart Shopping

In today's fast-paced world, technology plays a crucial role in helping consumers make informed decisions, and this holds true for shopping for auto insurance as well

AI and Big Data Analytics in Finding the Best Deals

AI and big data analytics have revolutionized the way insurance companies operate and how consumers shop for insurance. These technologies analyze vast amounts of data to provide personalized quotes based on individual risk factors, driving habits, and other relevant information.

By utilizing AI-powered tools, consumers can compare multiple quotes quickly and easily, ensuring they get the best coverage at the most competitive prices.

Blockchain Technology for Trust and Security

Blockchain technology is transforming the insurance industry by enhancing trust and security in transactions. By creating secure, transparent, and immutable records of insurance policies, claims, and payments, blockchain technology reduces the risk of fraud and improves the efficiency of insurance processes.

Consumers can have peace of mind knowing that their data is secure and that they are dealing with trustworthy insurance providers.

Impact of InsurTech Companies

InsurTech companies are disrupting the traditional insurance market by offering innovative solutions that streamline the insurance shopping experience. These companies leverage technology to provide customized insurance products, simplify the claims process, and offer digital platforms for easy access to insurance services.

As a result, consumers can expect a more user-friendly, efficient, and transparent insurance shopping experience when dealing with InsurTech companies.

Optimize Coverage and Costs

When it comes to auto insurance, optimizing coverage and costs is crucial to ensure you have the protection you need at a price you can afford. By customizing your coverage, bundling policies, and negotiating premiums, you can find the right balance between adequate protection and cost savings in 2025.

Customize Coverage Based on Individual Needs

It's essential to assess your individual needs and preferences when customizing your auto insurance coverage. Consider factors such as your driving habits, the value of your vehicle, and your risk tolerance to determine the appropriate level of coverage for you.

- Evaluate your coverage limits for liability, collision, and comprehensive insurance to match your needs.

- Consider adding optional coverages like roadside assistance, rental car reimbursement, or gap insurance for added protection.

- Review your deductible amounts to find a balance between out-of-pocket costs and premium savings.

Bundling Insurance Policies for Cost Savings

Bundling multiple insurance policies with the same provider can lead to significant cost savings in 2025. By combining your auto insurance with other policies such as home or renters insurance, you may qualify for discounts or lower premiums.

- Contact your insurance provider to inquire about bundling options and available discounts.

- Compare the total cost of bundling policies versus purchasing them separately to ensure savings.

- Review the coverage details of each bundled policy to guarantee adequate protection across the board.

Negotiating Premiums for Better Deals

Don't be afraid to negotiate with insurance providers to secure better premiums and discounts. In 2025, many insurers are open to negotiations to retain customers and remain competitive in the market.

- Research and compare quotes from multiple insurance providers to leverage competitive pricing.

- Highlight any discounts or safe driving records that may qualify you for lower premiums.

- Be prepared to negotiate with your current insurer by presenting lower quotes from other companies for potential price matching.

Closing Summary

In conclusion, mastering the art of shopping for auto insurance like a pro in 2025 requires a blend of knowledge, research, and strategic thinking. By implementing the tips and techniques discussed, you'll be well-equipped to secure the best coverage at optimal costs, ensuring peace of mind on the road ahead.

FAQ Summary

What are the key factors that influence auto insurance rates?

Factors such as driving record, age, location, and type of vehicle can impact auto insurance rates in 2025. Insurers also consider credit score and claims history when determining premiums.

How can bundling insurance policies help save costs in 2025?

Bundling multiple insurance policies with the same provider, such as auto and home insurance, can often lead to discounts or reduced premiums, resulting in cost savings for policyholders.

What role does blockchain technology play in auto insurance transactions?

Blockchain technology enhances trust and security in auto insurance transactions by creating transparent and immutable records of policyholder information and claims, reducing fraud and streamlining processes.