Embark on a journey of understanding as we delve into the intricacies of comparing auto insurance quote options side by side. From exploring different coverage types to utilizing online tools, this guide will equip you with the knowledge needed to make informed decisions about your auto insurance.

As we navigate through the key factors and details involved in comparing quotes, you'll gain valuable insights that can help you secure the best insurance deal for your needs.

Factors to Consider When Comparing Auto Insurance Quotes

When comparing auto insurance quotes, it's essential to consider various factors to ensure you're getting the coverage you need at a price that fits your budget.

Types of Coverage to Compare

- Bodily Injury Liability: This coverage helps pay for the medical expenses of others if you are at fault in an accident.

- Property Damage Liability: This coverage helps pay for damages to another person's property if you are at fault in an accident.

- Collision Coverage: This coverage helps pay for repairs to your vehicle after a collision with another vehicle or object.

- Comprehensive Coverage: This coverage helps pay for damages to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage helps protect you if you are in an accident with a driver who has insufficient or no insurance.

Importance of Each Coverage Type

- Bodily Injury Liability and Property Damage Liability are crucial to protect your assets in case of an accident where you are at fault.

- Collision Coverage and Comprehensive Coverage are important for repairing or replacing your vehicle in various situations.

- Uninsured/Underinsured Motorist Coverage provides added protection in case you are involved in an accident with an uninsured or underinsured driver.

Impact of Coverage Levels on Premiums

Increasing your coverage limits or adding additional coverage types will typically result in higher premiums.

- For example, opting for higher Bodily Injury Liability limits can increase your premium but offer more financial protection in case of a severe accident.

- Choosing a lower deductible for Collision Coverage may lead to a higher premium but lower out-of-pocket costs when filing a claim.

Gathering and Organizing Quote Information

When comparing auto insurance quotes side by side, it is essential to gather quotes from multiple insurance companies to ensure you are getting the best deal possible. Requesting quotes from different providers can help you compare prices, coverage options, and discounts available.

Requesting Quotes from Multiple Insurance Companies

- Start by researching reputable insurance companies in your area or online.

- Contact each company directly through their website or by phone to request a quote.

- Provide accurate information about your driving history, vehicle details, and coverage preferences to receive an accurate quote.

- Ask about any available discounts or promotions that may apply to your situation.

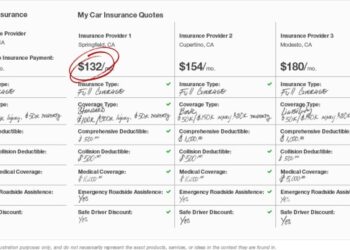

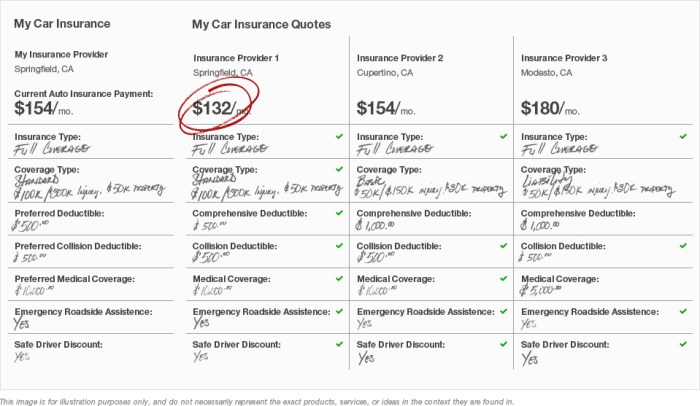

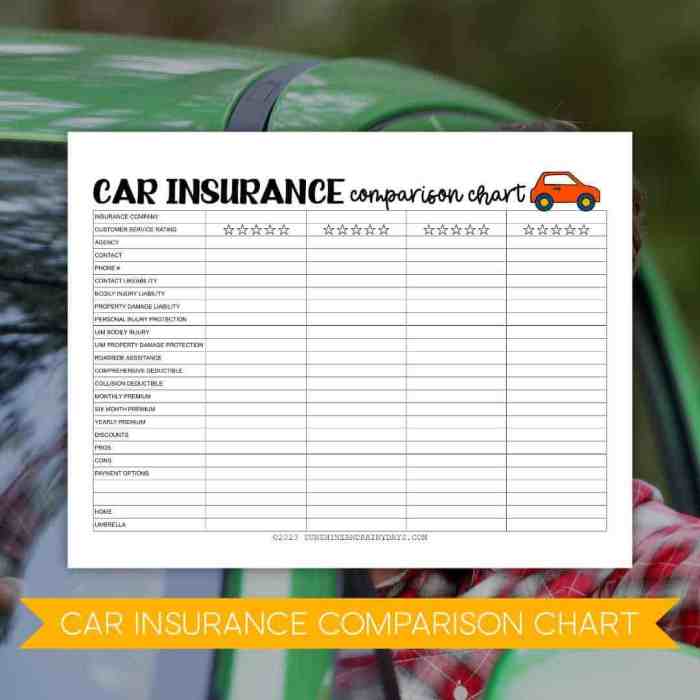

Organizing Quotes for Easy Comparison

- Create a spreadsheet or document to input each quote, including the insurance company name, quoted price, coverage details, and any additional notes.

- Organize the quotes in a clear and concise manner to easily compare the different options available.

- Consider color-coding or highlighting important information to quickly identify key differences between quotes.

- Review the quotes side by side to determine which one offers the best value for your specific needs.

Ensuring Accuracy in the Information Provided

- Double-check all the details you provide when requesting a quote to ensure accuracy.

- Verify that the information about your driving record, vehicle make and model, and coverage preferences is correct.

- Ask the insurance company to explain any discrepancies or unclear details in the quote to avoid misunderstandings later on.

- Keep a record of all communication and documentation related to each quote for future reference.

Understanding Policy Details and Fine Print

When comparing auto insurance quotes side by side, it's crucial to dive into the policy details and fine print to fully understand what each option offers. Here are some key factors to consider:

Reviewing and Comparing Deductibles

- Compare the deductibles offered by each policy. A deductible is the amount you'll have to pay out of pocket before your insurance kicks in to cover the rest of the cost.

- Consider how the deductible amount affects your premium. Typically, higher deductibles result in lower premiums, but you'll need to pay more upfront if you need to file a claim.

- Choose a deductible that you can comfortably afford in case of an accident or damage to your vehicle.

Differences in Coverage Limits and Premium Impact

- Understand the coverage limits of each policy. This refers to the maximum amount the insurance company will pay out for a covered claim.

- Higher coverage limits usually mean higher premiums, but they provide more financial protection in case of a significant accident.

- Consider your personal risk tolerance and budget when deciding on coverage limits.

Understanding Exclusions and Additional Benefits

- Review the exclusions in each policy, which specify what is not covered. Make sure you understand any limitations or restrictions that may apply.

- Look for any additional benefits or perks offered by each insurance provider. This could include roadside assistance, rental car coverage, or other valuable services.

- Consider how these exclusions and benefits align with your needs and priorities to choose the policy that best suits your requirements.

Utilizing Online Tools and Resources

When comparing auto insurance quotes, utilizing online tools and resources can streamline the process and help you make an informed decision. Online tools allow you to easily compare quotes side by side, estimate premiums, and explore different policy options.

Websites and Tools for Comparing Quotes

- Insurance comparison websites: Websites like Compare.com, The Zebra, and Gabi allow you to input your information once and receive quotes from multiple insurance companies side by side.

- Insurance company websites: Many insurance companies offer online quote tools on their websites, making it convenient to compare their own policies.

Using Online Calculators to Estimate Premiums

Online calculators provided by insurance companies or comparison websites can help you estimate your premium based on factors such as your driving history, vehicle information, and coverage preferences. By inputting accurate information, you can get a rough idea of how much you might pay for auto insurance.

Benefits of Using Comparison Websites

- Convenience: Comparison websites save you time by gathering quotes from multiple insurers in one place.

- Transparency: These websites make it easy to see the details of each policy side by side, allowing for a clear comparison of coverage and pricing.

- Potential savings: By comparing quotes from different insurers, you can find the best deal and potentially save money on your auto insurance premiums.

Epilogue

In conclusion, mastering the art of comparing auto insurance quote options side by side can lead to significant cost savings and better coverage. By applying the tips and strategies Artikeld in this guide, you'll be well-equipped to make confident decisions when choosing an auto insurance policy.

Quick FAQs

What types of coverage should I compare when looking at auto insurance quotes?

You should compare liability coverage, collision coverage, comprehensive coverage, and any additional coverage options offered by insurance companies.

How can I ensure the accuracy of the information provided in each insurance quote?

To ensure accuracy, double-check all the details you provide to insurance companies, such as your driving history, vehicle information, and desired coverage levels.

What are some tips for understanding policy details like deductibles and coverage limits?

When reviewing policies, pay attention to deductibles (the amount you pay before insurance kicks in) and coverage limits (the maximum amount your insurer will pay for a covered claim).

Are there any recommended online tools for comparing auto insurance quotes side by side?

Some popular tools include Compare.com, Gabi, and NerdWallet, which allow you to compare quotes from multiple insurers in one place.