Delve into the world of auto insurance apps with our guide on the best apps to shop for auto insurance on your phone. This engaging introduction sets the stage for a journey filled with valuable insights and practical advice.

Explore the realm of user-friendly interfaces, obtaining multiple quotes, customizing coverage options, and secure payment methods to streamline your auto insurance shopping experience.

Researching Auto Insurance Apps

When it comes to shopping for auto insurance, using apps on your smartphone can make the process much more convenient and efficient. Here are some of the top-rated auto insurance apps available and the benefits of using them:

List of Top-Rated Auto Insurance Apps:

- GEICO Mobile

- Progressive

- Allstate Mobile

- State Farm

Benefits of Using Auto Insurance Apps:

- Convenience: Easily access your policy information and make changes on-the-go.

- Comparing Rates: Quickly compare quotes from multiple insurance providers.

- Claims Processing: File and track claims directly through the app.

Comparison of Features Offered by Different Auto Insurance Apps:

| App | Key Features |

|---|---|

| GEICO Mobile | Virtual ID cards, roadside assistance, and bill payment options. |

| Progressive | Snapshot feature for safe driving discounts, pet injury coverage, and Name Your Price tool. |

| Allstate Mobile | Drivewise for safe driving rewards, QuickFoto Claim for quick claims processing, and roadside assistance. |

| State Farm | Drive Safe & Save for safe driving discounts, Pocket Agent for policy management, and claims filing. |

User-Friendly Interface

Creating a user-friendly interface in an auto insurance app is crucial to ensure a seamless shopping experience for users. A user-friendly interface should be intuitive, visually appealing, easy to navigate, and provide quick access to essential features. The overall design should be clean and organized, with clear labels and instructions to guide users through the app.

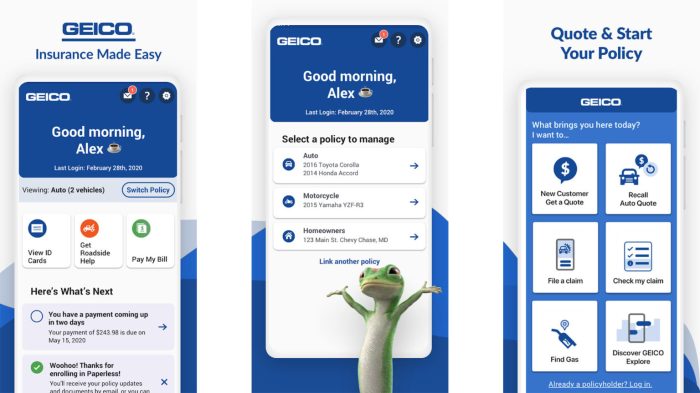

Examples of Auto Insurance Apps with Intuitive Interfaces

- Geico Mobile: Geico's app offers a user-friendly interface with a simple layout, easy access to policy information, and a streamlined process for submitting claims.

- Progressive: Progressive's app features a clean design, personalized policy details, and a user-friendly claims submission process, making it convenient for users to manage their auto insurance.

- Allstate Mobile: Allstate's app provides users with a visually appealing interface, easy-to-use tools for policy management, and quick access to roadside assistance services.

The Importance of Ease of Navigation in an App for Shopping Auto Insurance

Navigating an auto insurance app should be intuitive and straightforward to help users find the information they need quickly. Easy navigation enhances the user experience, reduces frustration, and increases user engagement with the app. A well-designed navigation system allows users to easily move between different sections, access policy details, make payments, and contact customer support when needed.

Overall, ease of navigation plays a significant role in shaping the overall user experience and satisfaction with an auto insurance app.

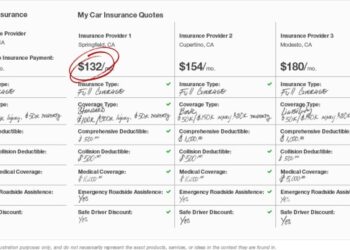

Obtaining Multiple Quotes

When using auto insurance apps, users can easily obtain multiple insurance quotes from different providers with just a few taps on their phone. This streamlined process saves time and allows users to compare various options conveniently.

Comparison with Traditional Methods

- Traditional methods of obtaining insurance quotes often involve contacting individual insurance companies either by phone or in person, which can be time-consuming and tedious.

- With auto insurance apps, users can input their information once and receive multiple quotes instantly, eliminating the need for multiple phone calls or visits to different providers.

- Apps also allow users to easily compare the quotes side by side on the same platform, providing a clear overview of the available options.

Advantages of Receiving Multiple Quotes

- By receiving multiple quotes, users can compare prices, coverage options, and discounts offered by different insurance companies, helping them make an informed decision.

- Having a variety of quotes also gives users bargaining power, as they can negotiate with providers based on the rates offered by competitors.

- Users can tailor their insurance policy to their specific needs and budget by selecting the most suitable option from the multiple quotes received.

Customizing Coverage Options

Auto insurance apps offer users the ability to customize coverage options to suit their specific needs and preferences. This feature allows users to tailor their insurance policies to provide the right level of protection for their vehicles.

Examples of Customizable Features

- Adjusting Deductibles: Users can choose different deductible amounts to adjust their premium costs.

- Adding Additional Coverage: Options like roadside assistance, rental car coverage, or gap insurance can be added as needed.

- Selecting Coverage Limits: Users can select the limits for liability coverage, comprehensive coverage, and collision coverage based on their individual requirements.

Benefits of Customizable Coverage Options

Having customizable coverage options is beneficial for users because it allows them to create a policy that meets their specific needs without paying for unnecessary coverage. By tailoring their insurance plans, users can ensure they have the right level of protection for their vehicles while also managing their premium costs effectively.

Secure Payment Options

In the realm of auto insurance apps, secure payment options play a crucial role in ensuring a positive user experience. Providing users with a variety of safe and convenient payment methods can significantly enhance their satisfaction and trust in the app.

Different Secure Payment Methods

- Credit/Debit Cards: Auto insurance apps often allow users to securely input their credit or debit card information for quick and easy payments. These details are encrypted to protect sensitive data.

- Digital Wallets: Some apps offer the option to link digital wallets like Apple Pay or Google Pay for seamless and secure transactions.

- Bank Transfers: Users can also choose to make payments directly from their bank accounts through secure bank transfer options available in the app.

Contribution to User Experience

Secure payment options not only ensure the safety of users' financial information but also contribute to a positive user experience by offering convenience and peace of mind. By providing various payment methods and ensuring the security of transactions, auto insurance apps can build trust and loyalty among their users.

Final Conclusion

In conclusion, navigating the landscape of auto insurance apps can be simplified with the right tools at your fingertips. From comparing features to securing the best coverage options, these apps offer convenience and efficiency in the palm of your hand.

FAQ Summary

How do auto insurance apps help users get multiple insurance quotes?

Auto insurance apps streamline the process by allowing users to input their information once and receive quotes from multiple insurance providers, saving time and effort.

What are some examples of customizable features in auto insurance apps?

Customizable features in auto insurance apps may include adjusting deductibles, adding or removing coverage options, and selecting payment frequencies.

Why is having secure payment options important in auto insurance apps?

Secure payment options ensure that users can make transactions safely and protect their sensitive financial information, contributing to a positive user experience.