Delving into Shop Auto Insurance for Teen Drivers: Save More Money, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

As we explore the world of auto insurance for teen drivers, the quest for savings becomes a crucial aspect. We'll uncover key strategies to help young drivers and their families navigate the complex landscape of insurance plans, discounts, and coverage options.

Researching Auto Insurance Options

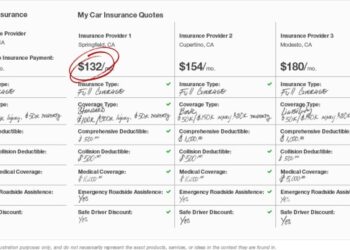

When it comes to getting auto insurance for teen drivers, it is crucial to research and compare different options to find the best coverage at the most affordable price.

Key Factors to Consider

- Cost of Premiums: Compare the cost of premiums from different insurance providers to find a plan that fits your budget.

- Coverage Options: Look into the coverage options offered by each provider to ensure you are getting the protection you need.

- Deductibles and Limits: Consider the deductibles and coverage limits of each plan to determine the out-of-pocket costs in case of an accident.

- Discounts: Check for any available discounts for teen drivers, such as good student discounts or safe driving discounts.

Benefits of Getting Multiple Quotes

Getting quotes from multiple insurance providers can help you:

- Save Money: By comparing quotes, you can find the most affordable option for your teen driver.

- Customize Coverage: Explore different plans to tailor coverage to your specific needs and budget.

- Understand Options: By reviewing multiple quotes, you can gain a better understanding of the insurance options available for teen drivers.

Understanding Cost-saving Opportunities

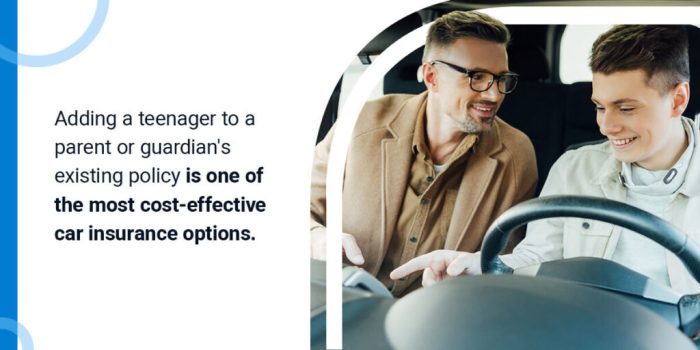

When it comes to saving money on auto insurance for teen drivers, there are several strategies that can help lower premiums and take advantage of discounts.

Qualify for Discounts on Auto Insurance

- Many insurance companies offer discounts for teen drivers who have completed a driver's education course. Encourage your teen to enroll in a certified program to qualify for this discount.

- Some insurers provide discounts for teens who have a clean driving record. Emphasize the importance of safe driving habits to your teen to help them qualify for this discount.

- Consider bundling your auto insurance policy with other insurance products, like homeowner's insurance, to potentially receive a multi-policy discount.

Maintaining Good Grades to Reduce Insurance Premiums

- Insurance companies often offer discounts for teen drivers who maintain a high GPA. Encourage your teen to focus on their studies and achieve good grades to qualify for this discount.

- Some insurers require proof of academic performance, so make sure your teen provides their report card or transcripts to take advantage of this cost-saving opportunity.

Impact of Choosing a Higher Deductible on Lowering Insurance Costs

Choosing a higher deductible can help lower insurance costs by reducing the insurer's risk and potentially decreasing your premium. However, it's important to weigh the cost savings against the financial impact of a higher out-of-pocket expense in the event of a claim.

Consider your budget and risk tolerance when deciding on the appropriate deductible for your teen driver's auto insurance policy.

Exploring Coverage Options

When it comes to auto insurance for teen drivers, it's important to understand the different coverage options available to ensure they have the right protection on the road. Let's delve into the details of the types of coverage options and their advantages and disadvantages.

Basic Liability Coverage vs. Full Coverage

- Basic Liability Coverage:

- Advantages:

- Meets state minimum requirements

- Usually cheaper than full coverage

- Disadvantages:

- May not cover all damages in an accident

- No coverage for your own vehicle

- Advantages:

- Full Coverage:

- Advantages:

- Provides comprehensive protection

- Covers damages to your vehicle

- Disadvantages:

- Higher premiums

- Additional cost compared to basic liability

- Advantages:

Importance of Adding Comprehensive Coverage

Adding comprehensive coverage to your teen driver's policy can offer additional protection in various situations. This type of coverage typically includes protection against:

- Theft

- Vandalism

- Natural disasters

- Damage from hitting an animal

Comprehensive coverage can be particularly valuable for teen drivers who may be more prone to accidents or incidents due to their lack of experience on the road. It provides peace of mind knowing that their vehicle is protected in a wide range of scenarios.

Considering Usage-based Insurance Programs

Usage-based insurance programs are a type of auto insurance that tracks the driving behavior of the policyholder through a telematics device installed in the vehicle. This device collects data on factors such as speed, braking, cornering, and time of day the vehicle is driven.

Based on this data, insurance companies can adjust premiums to reflect the actual risk posed by the driver.

How Usage-based Insurance Programs Work

Usage-based insurance programs monitor driving habits to determine insurance premiums. Safe driving behaviors, such as obeying speed limits, avoiding sudden stops, and driving during less risky times, can lead to lower insurance costs. On the other hand, risky behaviors may result in higher premiums.

Popular Insurance Companies Offering Usage-based Programs

- Progressive Snapshot: Progressive offers the Snapshot program, which tracks driving habits and adjusts premiums accordingly.

- Allstate Drivewise: Allstate's Drivewise program rewards safe driving habits with discounts on auto insurance.

- State Farm Drive Safe & Save: State Farm's program provides personalized feedback on driving habits and offers discounts for safe driving.

Benefits of Safe Driving Habits

By participating in a usage-based insurance program and demonstrating safe driving habits, teen drivers can potentially lower their insurance premiums. Consistently following traffic laws, avoiding distractions while driving, and practicing defensive driving techniques can lead to cost savings on auto insurance.

Ultimate Conclusion

In conclusion, navigating the realm of auto insurance for teen drivers can be a daunting task, but with the right knowledge and approach, significant savings are within reach. By shopping smartly and understanding the various cost-saving opportunities and coverage options available, both teen drivers and their parents can secure a policy that not only protects but also saves money in the long run.

FAQ Guide

What factors should I consider when comparing insurance plans for teen drivers?

When comparing insurance plans for teen drivers, factors such as coverage options, discounts available, and the reputation of the insurance provider should be carefully evaluated to ensure the best value for money.

How can teen drivers qualify for discounts on auto insurance?

Teen drivers can qualify for discounts on auto insurance by maintaining good grades, completing a defensive driving course, and driving a safe vehicle equipped with safety features.

Why is adding comprehensive coverage important for teen drivers?

Adding comprehensive coverage for teen drivers is important as it provides protection against non-collision related incidents such as theft, vandalism, and natural disasters.