Starting with Shop Car Insurance Quotes Online: What to Look For, the discussion unfolds in an engaging manner, offering unique insights that captivate readers.

The following paragraph delves into informative details about the topic.

Understanding Car Insurance Quotes

When it comes to car insurance, understanding the quotes you receive is essential to making informed decisions. A car insurance quote typically includes several components that determine the cost of your coverage.

Components of a Car Insurance Quote

- The type of coverage you choose, such as liability, collision, comprehensive, or personal injury protection.

- Your deductible amount, which is the out-of-pocket expense you must pay before your insurance kicks in.

- Your driving record, including any past accidents or traffic violations.

- The make and model of your vehicle, as well as its age and condition.

- Your location, as insurance rates can vary based on where you live.

Factors Influencing the Cost of Car Insurance Quotes

- Age and driving experience: Younger drivers and those with less experience typically pay higher premiums.

- Credit score: A lower credit score can result in higher insurance rates.

- Annual mileage: The more you drive, the higher your risk of accidents, which can impact your premium.

- Insurance history: A history of claims can lead to higher rates.

Impact of Coverage Levels on Insurance Quotes

- Choosing higher coverage limits and lower deductibles can result in higher premiums but provide more comprehensive protection.

- Opting for minimum coverage may lower your premium but leave you more exposed in the event of an accident.

- Adding optional coverages like roadside assistance or rental car reimbursement can increase your premium but offer added benefits.

Importance of Shopping Online

Shopping for car insurance quotes online offers several benefits that can make the process more convenient and efficient for consumers.

Benefits of Online Shopping

- Convenience: Online shopping allows individuals to compare quotes from multiple insurance providers without the need to visit different agencies in person. This saves time and effort for the consumer.

- Accessibility: With online tools, consumers can easily access and compare quotes at any time of the day, making it more convenient for those with busy schedules.

- Transparency: Online platforms often provide detailed information about coverage options, discounts, and terms, allowing consumers to make informed decisions about their car insurance.

Efficiency of Online Tools

Online tools play a crucial role in helping consumers compare multiple car insurance quotes efficiently. These tools typically provide:

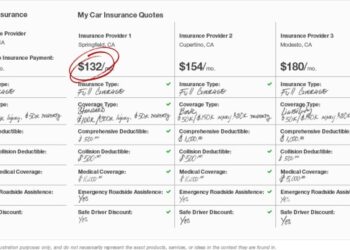

- Side-by-side comparisons: Online platforms allow users to view quotes from different insurance providers in a clear and organized manner, making it easier to identify the best options.

- Customization options: Consumers can input their specific coverage needs and preferences to receive personalized quotes tailored to their requirements.

- Instant quotes: Online tools can generate quotes instantly, providing consumers with quick access to pricing information without delays.

Key Factors to Consider

When reviewing car insurance quotes online, there are several key factors to consider that can impact the coverage you receive and the premiums you pay. Understanding these factors is crucial in making an informed decision about your car insurance policy.

Coverage Options to Look For

- Liability Coverage: This covers costs associated with injuries and property damage you cause to others in an accident.

- Collision Coverage: This pays for damages to your own vehicle in the event of a collision.

- Comprehensive Coverage: This covers damages to your vehicle not caused by a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're involved in an accident with a driver who has insufficient or no insurance.

Significance of Deductibles

One important factor to consider when comparing car insurance quotes is the deductible. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, but it also means you'll have to pay more in the event of a claim.

On the other hand, a lower deductible means higher premiums but less out-of-pocket costs when filing a claim.

Tips on Evaluating Insurance Providers

- Check Customer Reviews: Look for feedback from current and former customers to get an idea of the company's reputation for customer service and claims handling.

- Financial Strength: Ensure the insurance provider is financially stable and able to pay out claims when needed. You can check their financial ratings from agencies like A.M. Best or Standard & Poor's.

- Customer Service: Evaluate how responsive and helpful the insurance company is when you have questions or need assistance. A reliable provider should offer excellent customer service.

Utilizing Comparison Websites

When shopping for car insurance, utilizing comparison websites can be a convenient and efficient way to find the best coverage at the most competitive rates. Here is a step-by-step guide on how to use these platforms effectively:

Entering Accurate Information

It is crucial to enter accurate information when using comparison websites to ensure that you receive precise insurance quotes. Make sure to input details such as your driving history, type of coverage needed, and vehicle information correctly to get the most accurate estimates.

Interpreting and Comparing Quotes

Once you have entered all the necessary information, comparison websites will provide you with quotes from different insurance providers. Here's how you can interpret and compare these quotes effectively:

- Pay attention to the coverage options offered by each provider to ensure they meet your needs.

- Compare the premiums and deductibles to determine which policy offers the best value for your budget.

- Look at additional features or discounts that may be included in the quotes to see if they align with your preferences.

- Check customer reviews and ratings for each insurance provider to gauge their reputation and customer service quality.

Wrap-Up

Concluding with a captivating summary that encapsulates the essence of the conversation.

Quick FAQs

What factors influence the cost of car insurance quotes?

Factors such as driving record, car model, and coverage level can impact the cost of car insurance quotes.

How do deductibles affect premiums?

Higher deductibles usually result in lower premiums, while lower deductibles lead to higher premiums.

Why is it important to enter accurate information when using comparison websites?

Accurate information ensures that the quotes received are precise and reflective of actual costs.