When it comes to shopping for car insurance, avoiding common mistakes is key. Let's dive into the top errors to steer clear of when comparing insurance quotes, ensuring you get the best deal possible.

Understanding what coverage you need, comparing quotes effectively, and not missing out on discounts are just a few areas to focus on. Stay tuned to unravel the secrets to navigating the car insurance market with ease.

Common Mistakes When Shopping for Car Insurance

When shopping for car insurance, it's crucial to avoid certain common mistakes that could impact the coverage you receive or the cost of your insurance premium. By being aware of these pitfalls, you can ensure that you get the best insurance deal that meets your needs.

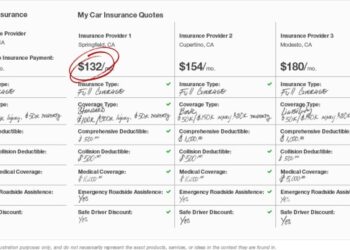

Not Comparing Multiple Quotes

One of the biggest mistakes people make when shopping for car insurance is not comparing quotes from multiple insurance providers. By only considering one or two options, you may miss out on better coverage or lower premiums available from other companies.

Providing Inaccurate Information

Another common mistake is providing inaccurate information when filling out the insurance application. Whether it's about your driving record, vehicle details, or personal information, inaccuracies can lead to higher premiums or denial of claims in the future.

Choosing the Minimum Coverage

Opting for the minimum required coverage may seem like a cost-effective choice, but it could leave you underinsured in case of an accident. It's essential to consider your individual needs and the potential risks you face on the road when selecting coverage options.

Not Reviewing Policy Details

Failing to review the policy details and exclusions can also be a costly mistake. Understanding what is covered and excluded in your insurance policy is crucial to avoid surprises when you need to file a claim.

Understanding Coverage Needs

Before comparing insurance quotes, it is crucial to have a clear understanding of your coverage needs. Failing to do so can result in selecting inadequate coverage that may not fully protect you in case of an accident or other unforeseen events.Different types of coverage serve various purposes and play a vital role in safeguarding you and your vehicle.

Here are some examples of common coverage types and their importance:

Liability Coverage

- Liability coverage protects you if you are at fault in an accident and covers the other party's medical expenses and property damage.

- Having sufficient liability coverage is essential to avoid out-of-pocket expenses in case of a lawsuit.

Collision Coverage

- Collision coverage pays for damages to your vehicle in the event of a collision with another vehicle or object.

- It is particularly important if you have a newer or more valuable car that would be costly to repair or replace.

Comprehensive Coverage

- Comprehensive coverage protects your vehicle from non-collision related damages, such as theft, vandalism, or natural disasters.

- It provides added peace of mind and financial protection against a wide range of risks.

Underestimating or overestimating your coverage needs can lead to mistakes that may leave you vulnerable or paying for coverage you don't need. By assessing your driving habits, the value of your vehicle, and potential risks, you can determine the right level of coverage to adequately protect yourself and your assets.

Comparing Quotes Effectively

When comparing car insurance quotes, it is essential to follow certain best practices to ensure you are making an informed decision that meets your coverage needs.

Ensuring Similar Coverage Options

- Review the coverage details carefully: Before comparing quotes, make sure you understand the types of coverage included in each quote. Look at the liability limits, deductibles, and any additional coverage options offered.

- Ask for a detailed breakdown: Request a breakdown of the coverage options from each insurance provider to ensure you are comparing similar policies. This will help you make an accurate comparison based on the coverage offered.

- Check for exclusions and limitations: Pay attention to any exclusions or limitations in the policy that may impact your coverage. Ensure that you are comparing quotes that provide the same level of protection.

Looking Beyond the Price

- Consider the reputation of the insurance company: While price is important, it is equally crucial to consider the reputation and customer service of the insurance provider. Look for reviews and ratings from other policyholders to gauge their satisfaction level.

- Evaluate the claims process: A smooth and efficient claims process is vital when selecting an insurance provider. Research how the company handles claims and whether they have a reputation for quick and fair settlements.

- Compare discounts and benefits: In addition to the price, compare the discounts and benefits offered by each insurance provider. Some companies may offer additional perks that can add value to your policy.

Overlooking Discounts and Savings Opportunities

When shopping for car insurance, it's important not to overlook the discounts and savings opportunities that insurance companies offer. Failing to take advantage of these discounts can end up costing you more in the long run

Common Discounts Offered by Insurance Companies

- Multi-Policy Discount: Many insurance companies offer discounts if you bundle your car insurance with other policies, such as homeowners or renters insurance.

- Good Driver Discount: If you have a clean driving record with no accidents or traffic violations, you may be eligible for a good driver discount.

- Good Student Discount: Students with good grades are often eligible for discounts on their car insurance premiums.

- Low Mileage Discount: If you don't drive your car frequently, you may qualify for a low mileage discount.

Why Overlooking Discounts Can Result in Paying More for Insurance

By failing to take advantage of available discounts, you may end up paying higher premiums than necessary. Insurance companies offer these discounts as incentives to attract customers and reward certain behaviors, such as safe driving or loyalty. Not capitalizing on these opportunities means missing out on potential savings.

Strategies for Maximizing Savings

- Ask About Available Discounts: When obtaining insurance quotes, make sure to inquire about all the discounts that may apply to you.

- Bundle Policies: Consider bundling your car insurance with other insurance policies to qualify for a multi-policy discount.

- Maintain a Good Driving Record: Safe driving can not only keep you safe on the road but also help you qualify for good driver discounts.

- Shop Around: Don't settle for the first insurance quote you receive. Compare quotes from multiple companies to find the best deal with applicable discounts.

Failing to Review Policy Details

When shopping for car insurance, one crucial mistake to avoid is failing to review policy details thoroughly. Understanding the specifics of your insurance policy is essential to ensure you have the coverage you need and avoid any surprises in the event of a claim.

Key Elements to Look for in an Insurance Policy

- Coverage Limits: Make sure you understand the maximum amount your policy will pay out for different types of claims.

- Deductibles: Know how much you'll have to pay out of pocket before your insurance kicks in.

- Exclusions: Be aware of what is not covered by your policy to avoid any misunderstandings.

- Add-Ons: Check if you have any additional coverage or optional add-ons included in your policy.

- Policy Term: Understand the duration of your policy and when it needs to be renewed.

Consequences of Not Understanding Policy Terms

Failure to review policy details can lead to significant consequences. If you don't understand the terms and conditions of your insurance policy, you may find yourself underinsured when you need coverage the most. This can result in financial strain and added stress during an already challenging situation, such as a car accident or theft.

Not Checking the Insurance Company’s Reputation

When shopping for car insurance, one crucial aspect that many people overlook is checking the reputation of the insurance company. Failing to research the reputation of an insurance provider can lead to potential issues in the future, such as claim disputes, poor customer service, or financial instability.

Ways to Check the Insurance Company’s Reputation

- Check financial stability: Look up the insurance company's financial ratings from agencies like A.M. Best, Standard & Poor's, or Moody's. A financially stable company is more likely to honor claims and provide good customer service.

- Read customer reviews: Visit online review platforms or forums to see what current and past customers have to say about their experiences with the insurance company. Pay attention to feedback on claim processing, customer service, and overall satisfaction.

- Check complaint records: Research the insurance company's complaint record with your state's insurance department. A high number of complaints can be a red flag and indicate potential issues.

Choosing a reputable insurance company can provide you with peace of mind knowing that your claims will be handled efficiently and that you will receive the support you need in case of an accident.

Final Review

As we wrap up our discussion on the top mistakes to avoid when shopping for car insurance quotes, remember that a little attention to detail can go a long way in securing the right coverage at the best price. By steering clear of these pitfalls, you're well on your way to making informed decisions about your car insurance needs.

FAQs

What are some common mistakes to avoid when shopping for car insurance?

Some common mistakes include underestimating coverage needs, not comparing quotes effectively, and overlooking discounts offered by insurance companies.

Why is it important to review policy details before making a decision?

Reviewing policy details is crucial to ensure you understand the coverage you're getting and the terms and conditions of the policy. This helps prevent any surprises or issues in the future.

How can I check the reputation of an insurance company?

You can research the financial stability and customer satisfaction ratings of insurance providers. Checking reviews and ratings from trusted sources can give you insight into the company's reputation.