Before delving into the world of auto insurance policies, it's crucial to arm yourself with knowledge about the key factors that can shape your decision-making process. This guide aims to provide you with valuable insights to help you navigate the complex landscape of auto insurance with confidence.

The following paragraphs will shed light on important considerations when shopping for auto insurance policies, ensuring you make informed choices tailored to your individual needs.

Factors to Consider When Shopping for Auto Insurance Policies

When shopping for auto insurance policies, there are several important factors to consider to ensure you get the coverage that best suits your needs and budget.

- Understanding Coverage Options:It is crucial to have a clear understanding of the different coverage options available when choosing an auto insurance policy. This includes liability coverage, comprehensive coverage, collision coverage, and more. Being aware of what each type of coverage entails will help you make an informed decision.

- Impact of Deductibles on Premium Costs:Deductibles play a significant role in determining your premium costs. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Generally, a higher deductible leads to lower premiums, while a lower deductible results in higher premiums.

Consider your financial situation and risk tolerance when choosing a deductible amount.

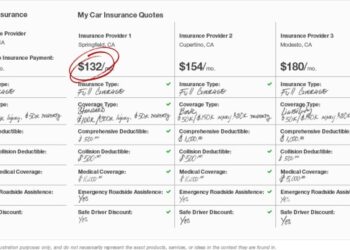

- Comparing Quotes from Multiple Providers:It is highly recommended to obtain quotes from multiple insurance providers before making a decision. By comparing quotes, you can ensure you are getting the best coverage at a competitive price. Be sure to compare not only the premium costs but also the coverage limits, deductibles, and any additional benefits offered by each provider.

Types of Auto Insurance Coverage

When shopping for auto insurance policies, it's important to understand the different types of coverage available to protect yourself and your vehicle in various situations.

Liability Coverage

Liability coverage helps pay for injuries and property damage you cause to others in a car accident. This type of coverage is typically required by law and helps protect you financially in case you are at fault in an accident.

For example, if you rear-end another vehicle and cause damage to their car, liability coverage would help cover the cost of repairs.

Comprehensive Coverage

Comprehensive coverage helps pay for damage to your car that is not caused by a collision, such as theft, vandalism, or natural disasters. This coverage is optional but can provide peace of mind knowing that your vehicle is protected in various non-collision scenarios.

For instance, if your car is stolen or damaged in a hailstorm, comprehensive coverage would help cover the cost of repairs or replacement.

Collision Coverage

Collision coverage helps pay for damage to your car if you collide with another vehicle or object. This coverage is also optional but can be beneficial in scenarios where your vehicle is damaged in a collision that is deemed your fault.

For example, if you accidentally hit a pole while parking and damage your car, collision coverage would help cover the cost of repairs.

Understanding State-Specific Insurance Requirements

It's crucial to be aware of the auto insurance requirements in your state to ensure you have the necessary coverage to legally operate your vehicle. Each state has its own minimum liability coverage limits that drivers must meet, so make sure to familiarize yourself with these requirements to avoid any penalties or fines for insufficient coverage.

Determining the Right Amount of Coverage

Determining the right amount of coverage for your auto insurance policy is crucial to ensure you are adequately protected in case of an accident. Several personal factors play a role in determining the appropriate coverage levels, including your driving history and the value of your vehicle.

Understanding concepts like underinsured and uninsured motorist coverage is also essential in making an informed decision.

Factors Influencing Coverage Needs

- Consider your driving history: If you have a clean driving record, you may be eligible for lower premiums. On the other hand, a history of accidents or traffic violations could result in higher rates.

- Evaluate the value of your vehicle: The age, make, and model of your car will impact the cost of repairs or replacement in the event of a claim. Consider the potential financial loss when choosing coverage limits.

Underinsured and Uninsured Motorist Coverage

- Underinsured motorist coverage protects you if the at-fault driver's insurance is not enough to cover your expenses. Uninsured motorist coverage steps in when the other driver has no insurance at all.

- These coverages are crucial in situations where the other party is unable to fully compensate you for damages, medical bills, or lost wages.

Assessing Appropriate Coverage Limits

- Review your financial situation: Consider how much you can afford to pay out of pocket in the event of an accident. Higher coverage limits offer greater protection but come with higher premiums.

- Consult with an insurance agent: An agent can help you assess your individual needs based on factors like assets, income, and risk tolerance.

- Regularly review and adjust your coverage: Life changes, such as buying a new car or moving to a different area, may require updates to your coverage levels.

Discounts and Savings Opportunities

When shopping for auto insurance, it's important to be aware of the various discounts and savings opportunities that insurance companies offer. These discounts can help you save money on your premiums, making it essential to inquire about them when comparing policies.One common discount offered by insurance companies is the multi-policy discount, which allows you to save money by bundling your auto insurance with other policies, such as homeowners or renters insurance.

By combining multiple policies with the same insurer, you can often enjoy significant savings on your overall insurance costs.Another way to save on auto insurance is by maintaining a safe driving record. Insurance companies often reward policyholders with clean driving histories by offering discounts for avoiding accidents and traffic violations.

By driving safely and responsibly, you can qualify for lower premiums and potentially save hundreds of dollars each year.When shopping for auto insurance, it's crucial to ask about all available discounts to ensure you're taking advantage of every opportunity to save money.

Whether it's a discount for bundling policies, having a safe driving record, or meeting other criteria set by the insurance company, exploring these savings opportunities can help you find the most affordable coverage that meets your needs.

Understanding Policy Exclusions and Limitations

When shopping for auto insurance, it is crucial to pay attention to the exclusions and limitations Artikeld in the policy documents

Common Exclusions or Limitations in Auto Insurance Policies

- Acts of God such as earthquakes, floods, or hurricanes may not be covered under a standard auto insurance policy.

- Intentional damage or illegal activities involving the vehicle may result in coverage exclusions.

- Using the vehicle for commercial purposes without proper coverage can lead to limitations in the policy.

- Uninsured or underinsured motorist coverage may have specific conditions that limit the scope of protection.

Potential Consequences of Overlooking Policy Details

- Not understanding the exclusions could result in denied claims when you need coverage the most.

- Violating the terms of the policy by engaging in excluded activities may lead to cancellation of coverage.

- Being unaware of limitations can leave you exposed to financial risks in certain situations.

Claims Process and Customer Service

When it comes to auto insurance, evaluating an insurance company's claims process is crucial. A reliable claims process ensures that you will receive the assistance you need in case of an accident or damage to your vehicle. Additionally, customer service plays a significant role in your overall experience with the insurance company.

Selecting an Insurer with Reliable Customer Service

- Research customer reviews and ratings to gauge the level of satisfaction with the insurer's customer service.

- Check if the insurer offers 24/7 customer support to assist you at any time of the day.

- Consider reaching out to the insurer's customer service department with any questions or concerns to see how they respond.

Significance of Reviews and Ratings

- Customer reviews and ratings can provide valuable insight into the quality of an insurer's customer service.

- Look for patterns in reviews to see if customers are generally satisfied or dissatisfied with the insurer's claims process and customer service.

- Consider third-party ratings from organizations like J.D. Power or AM Best to get an unbiased assessment of the insurer's performance.

Revisiting and Reviewing Policies Periodically

It is crucial to regularly revisit and review your auto insurance policies to ensure you have adequate coverage that meets your current needs. Life is dynamic, and changes happen that can impact your insurance requirements. By staying proactive and reviewing your policies periodically, you can avoid being underinsured or overpaying for coverage that you no longer need.

Life Events or Changes Necessitating Updates

- Changes in driving habits, such as a longer commute or driving for work purposes

- Adding a new driver to your policy, such as a teenager or spouse

- Purchasing a new vehicle or selling an existing one

- Relocating to a new area with different insurance requirements

- Changes in your financial situation that may impact your coverage needs

Checklist for Reviewing Policies Periodically

- Review your coverage limits and make adjustments based on changes in your life or financial situation.

- Check if you qualify for any new discounts or savings opportunities that were not available when you initially purchased your policy.

- Ensure that you have the right types of coverage for your specific needs, such as comprehensive, collision, or uninsured motorist coverage.

- Consider increasing your liability coverage limits to protect your assets in case of a severe accident.

- Update your policy information, such as address, vehicles, drivers, and mileage, to ensure accuracy.

- Compare quotes from different insurance companies to see if you can get better coverage or rates elsewhere.

- Contact your insurance agent or company to discuss any changes or updates to your policy and ensure you understand your coverage.

Last Word

In conclusion, being well-versed in the nuances of auto insurance policies empowers you to make sound decisions that protect both your vehicle and financial well-being. By keeping these 7 essential factors in mind, you're better equipped to navigate the realm of auto insurance with ease and assurance.

Essential FAQs

What factors should I consider when shopping for auto insurance policies?

Understanding coverage options, considering deductibles' impact on costs, and comparing quotes from multiple providers are key factors to keep in mind.

What types of auto insurance coverage should I be aware of?

Liability, comprehensive, and collision coverage are essential types to understand, each serving different purposes based on specific scenarios.

How do personal factors influence the right amount of coverage needed?

Personal factors like driving history and vehicle value play a crucial role in determining the appropriate coverage limits tailored to individual needs.

What are some common discounts offered by insurance companies?

Bundling policies, maintaining a safe driving record, and other factors can lead to savings through various discounts offered by insurers.

Why is it important to revisit and review policies periodically?

Regularly reviewing policies ensures continued adequate coverage, especially in light of life events or changes that may necessitate updates to auto insurance coverage.