Why You Should Shop Car Insurance Quotes Every Year sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Exploring the importance of annual car insurance quote comparisons can lead to substantial savings and better coverage options. This practice allows individuals to stay informed about changing rates, understand influencing factors, and make informed decisions for their insurance needs.

Importance of Shopping Car Insurance Quotes Annually

Car insurance is a vital aspect of owning a vehicle, providing financial protection in case of accidents or unforeseen events. However, insurance rates are not static and can change over time. This is why it is crucial to review and compare car insurance quotes annually to ensure you are getting the best coverage at the most competitive rates.

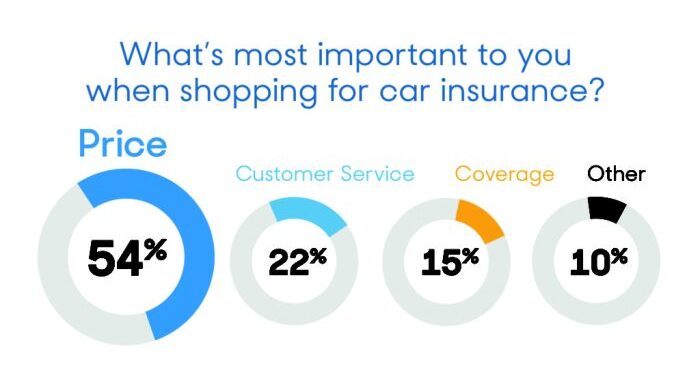

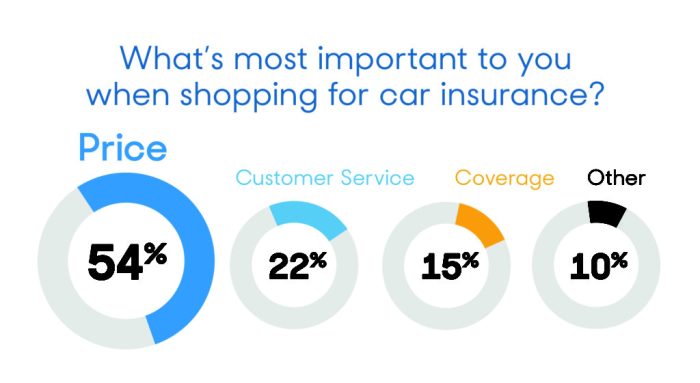

Potential Benefits of Shopping Around for Insurance Rates Yearly

- Cost Savings: By comparing quotes from different insurance providers, you may find lower premiums or better discounts that can result in significant cost savings.

- Updated Coverage: Your insurance needs may change over time, and shopping for quotes annually allows you to update your coverage to better suit your current circumstances.

- Policy Enhancements: Insurance companies often introduce new policy features or discounts, so shopping around annually can help you take advantage of these offerings.

Why Insurance Rates Can Change Over Time

Insurance rates are influenced by various factors, including changes in your driving record, location, age, and even market trends. By comparing quotes annually, you can ensure that you are aware of any rate changes and make informed decisions about your coverage.

Essentiality of Comparing Quotes Regularly

Regularly comparing car insurance quotes allows you to stay informed about the latest offerings in the market and potentially save money on your premiums.

Factors Affecting Car Insurance Rates

When it comes to determining car insurance rates, several factors come into play that can significantly impact the cost of your premiums. Understanding these factors can help you make informed decisions when shopping for car insurance.

Personal Circumstances

- Your age, gender, marital status, and occupation can all influence your car insurance rates. For example, younger drivers are typically charged higher premiums due to their lack of driving experience.

- Your credit score can also affect your insurance rates, as insurers often use it to predict your likelihood of filing a claim.

Driving Record

- Your driving record, including any past accidents or traffic violations, can have a significant impact on your car insurance rates. Drivers with a history of accidents or tickets are considered higher risk and may face higher premiums.

Location

- Where you live can also affect your car insurance rates. Urban areas with higher crime rates and traffic congestion tend to have higher premiums than rural areas.

- The frequency of natural disasters in your area can also impact your rates, as insurers consider the risk of damage to your vehicle.

Vehicle Type

- The make, model, and year of your vehicle can influence your insurance rates. Expensive or high-performance cars may cost more to insure due to the higher cost of repairs or replacement.

Coverage Options and Deductibles

- The type and amount of coverage you choose, such as liability, collision, and comprehensive coverage, can impact your insurance rates. Opting for higher coverage limits will result in higher premiums.

- Your deductible, or the amount you pay out of pocket before your insurance kicks in, can also affect your rates. A higher deductible typically means lower premiums, but you'll pay more in the event of a claim.

Comparison of Insurance Coverage Options

When it comes to car insurance, there are different types of coverage options available to choose from. It is essential to understand the advantages and disadvantages of each type to make an informed decision based on your individual needs and budget.

Comprehensive Coverage

- Comprehensive coverage provides protection for damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters.

- It offers peace of mind knowing that your car is covered in various non-collision scenarios.

- However, comprehensive coverage tends to be more expensive compared to other types of insurance.

Collision Coverage

- Collision coverage helps pay for repairs to your vehicle in case of an accident, regardless of fault.

- It is beneficial if you have a newer or more expensive car that would require costly repairs.

- Keep in mind that collision coverage may come with a deductible that you need to pay out of pocket.

Liability Coverage

- Liability coverage is mandatory in most states and helps cover costs if you are at fault in an accident that causes injury or property damage to others.

- It is crucial to have enough liability coverage to protect your assets in case of a lawsuit.

- However, liability coverage does not pay for damages to your vehicle.

Other Coverage Options

- Other coverage options may include uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection.

- These additional coverages can provide extra protection in specific situations, such as hit-and-run accidents or medical expenses for you and your passengers.

- Consider your individual circumstances and driving habits to determine if these additional coverages are necessary for you.

How to Obtain and Compare Car Insurance Quotes

Obtaining and comparing car insurance quotes is essential to finding the best coverage at the most competitive rates. By following these steps, you can effectively compare quotes and make an informed decision.

Step 1: Gather Your Information

- Before requesting quotes, gather important information such as your driving history, vehicle details, and current coverage limits.

- Having this information readily available will help you provide accurate details to insurance providers.

Step 2: Research Insurance Providers

- Research different insurance companies to identify reputable providers with a history of reliable customer service.

- Check customer reviews and ratings to ensure you are selecting a trustworthy insurance company.

Step 3: Request Quotes

- Contact multiple insurance providers to request quotes based on the information you gathered.

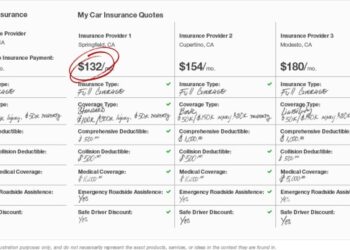

- Ensure you request quotes for the same coverage limits and deductibles to make an accurate comparison.

Step 4: Compare Coverage Options

- Review each quote carefully, paying attention to coverage limits, exclusions, deductibles, and additional benefits.

- Consider the overall value of the coverage offered by each provider, not just the price.

Step 5: Utilize Online Tools

- Use online comparison tools to input your information once and receive quotes from multiple providers.

- These tools can help streamline the comparison process and provide you with a comprehensive overview of available options.

End of Discussion

In conclusion, regularly shopping for car insurance quotes not only ensures financial savings but also guarantees that you have the most suitable coverage for your needs. By staying proactive and informed, you can navigate the insurance landscape with confidence and peace of mind.

FAQ Section

Why is it important to shop car insurance quotes annually?

Reviewing car insurance quotes yearly helps individuals keep track of changing rates, discover potential savings, and ensure they have the most suitable coverage for their needs.

What factors can influence car insurance rates?

Car insurance premiums can be affected by personal circumstances, driving record, location, vehicle type, coverage options, and deductibles.

How can I effectively compare car insurance quotes?

Obtain quotes from various providers, consider coverage limits and exclusions, and utilize online tools to compare quotes efficiently.