Delve into the world of car insurance quotes and premium reduction with this detailed guide. From understanding the intricacies of insurance quotes to practical tips on lowering premiums, this article is your go-to resource for all things car insurance.

Learn the step-by-step process of comparing quotes, the benefits of using comparison websites, and strategies for customizing coverage to fit your needs perfectly.

Understanding Car Insurance Quotes

When it comes to car insurance, understanding the components of a quote is crucial to making an informed decision. Let's dive into the details to help you navigate the world of insurance quotes effectively.

Components of a Car Insurance Quote

- Liability Coverage: This covers bodily injury and property damage that you may cause to others in an accident.

- Collision Coverage: Protects your vehicle in case of a collision with another vehicle or object.

- Comprehensive Coverage: Covers damage to your car from non-collision incidents like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers in case of an accident, regardless of fault.

Factors Influencing Insurance Premiums

- Driving Record: A history of accidents or traffic violations can increase your premiums.

- Age and Gender: Younger drivers and males typically pay higher premiums.

- Vehicle Type: The make, model, and age of your car can impact your insurance costs.

- Location: Where you live and park your car can affect your rates.

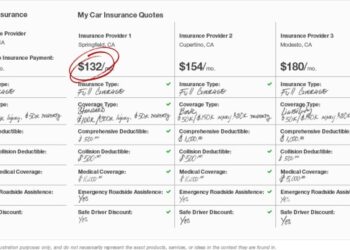

Importance of Comparing Quotes

- By comparing quotes from multiple providers, you can find the best coverage at the most competitive price.

- Each insurance company weighs factors differently, so shopping around can save you money.

Types of Coverage in a Car Insurance Quote

- Bodily Injury Liability: Covers medical expenses and legal fees if you injure someone in an accident.

- Property Damage Liability: Pays for damage to someone else's property caused by your car.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're in an accident with a driver who has insufficient or no insurance.

How to Shop for Car Insurance Quotes

When it comes to shopping for car insurance quotes, there are several steps you can take to ensure you get the best coverage at the most competitive rates. From obtaining and comparing quotes online to effectively communicating with insurance agents, here's a guide to help you navigate the process smoothly.

Using Comparison Websites for Car Insurance Shopping

- Start by visiting reputable comparison websites that allow you to input your information once and receive multiple quotes from different insurance providers.

- Compare the coverage options, deductibles, and premiums offered by each provider to find the best value for your needs.

- Take note of any discounts or special promotions that may apply to further reduce your premium costs.

Communicating with Insurance Agents for Quotes

- Be clear and concise about the type of coverage you're looking for and provide accurate information about your driving history and vehicle details.

- Ask questions about any terms or conditions you don't understand to ensure you're fully informed about the coverage you're purchasing.

- Request quotes in writing and review them carefully to confirm that all the details match what was discussed.

Customizing Coverage Options to Suit Individual Needs

- Consider your budget and the level of coverage you need based on factors like your driving habits, commute distance, and vehicle type.

- Explore additional coverage options such as roadside assistance, rental car reimbursement, and gap insurance to enhance your policy.

- Work with your insurance agent to tailor your coverage to meet your specific needs and ensure you're adequately protected in case of accidents or other unforeseen events.

Lowering Premiums on Car Insurance

When it comes to reducing your car insurance premiums, there are several strategies you can implement to save money without sacrificing coverage. By understanding how deductibles, policy bundling, and discounts can impact your premiums, you can make informed decisions to lower your costs.

Impact of Deductible Amounts on Premium Costs

One effective way to lower your car insurance premiums is by adjusting your deductible amount. A deductible is the amount you pay out of pocket before your insurance kicks in. Typically, the higher the deductible you choose, the lower your premiums will be.

However, it's important to find a balance that you can afford in case of an accident.

Increasing your deductible from $500 to $1,000 could potentially reduce your premium by 15% to 30%.

Role of Bundling Policies in Obtaining Lower Premiums

Another way to save on car insurance premiums is by bundling your policies. Many insurance companies offer discounts if you purchase multiple policies from them, such as combining your auto and home insurance. By bundling, you can enjoy lower overall premiums compared to purchasing separate policies from different insurers.

Examples of Discounts to Lower Car Insurance Premiums

Insurance companies often provide various discounts that can help you reduce your car insurance premiums. Some common discounts include:

- Multi-vehicle discount for insuring more than one vehicle with the same insurer.

- Good driver discount for maintaining a clean driving record.

- Low mileage discount for driving fewer miles annually.

- Good student discount for young drivers with good academic performance.

- Safety feature discount for vehicles equipped with anti-theft devices or safety features.

Ultimate Conclusion

In conclusion, mastering the art of shopping for car insurance quotes and reducing premiums is essential for every driver. Armed with the knowledge from this guide, you can navigate the world of insurance with confidence and ease.

Query Resolution

What factors influence insurance premiums?

Insurance premiums are influenced by factors such as age, driving record, location, and the type of vehicle being insured.

How can I effectively communicate with insurance agents for quotes?

Be clear about your coverage needs, ask relevant questions, and provide accurate information to get accurate quotes.

Are there discounts available to help lower car insurance premiums?

Yes, insurance companies offer discounts for things like safe driving, bundling policies, and having certain safety features on your vehicle.